A Greater China Currency Trading Bloc is Emerging in Asia

greg beier macroESG.com tuesday 13 october 2020 09:11 PM EDT

Subscribe to the Macro ESG Podcast: Apple Spotify Google Anchor links to other providers.

Markets, Politics, and Technology for a Sustainable Future

Actionable Ideas:

-

Keep a sharp eye on the RMB, the Korean won, the Taiwanese dollar, the Philippine peso, and the Malaysian ringgit.

-

Similarly, monitor the large non-bloc nations of India, Japan, Indonesia, and Australia.

-

Pay close attention to statements from China seeking to tighten the bloc and harm non-bloc states like China’s threat today that it would not buy coal from Australia.

The Chinese yuan turned on a dime and bottomed out against the US dollar on May 27 – the day that George Floyd died while being arrested that then sparked several months of intense national, even global, protests.

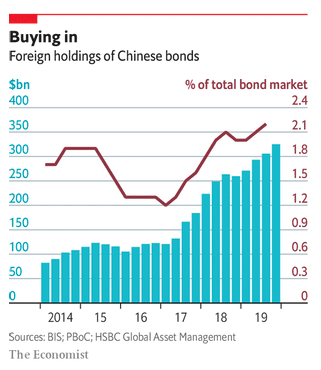

As the Chinese yuan’s value is controlled by the People’s Bank of China – essentially the Chinese government – turning up the yuan as the US dollar fell against major currencies was a brilliant piece of financial theater. China is seeking to draw global investors into its currently higher yielding debt markets and its equity markets (the latter lack clear and proper share registers which are quite likely the single biggest failure of corporate governance anywhere in the world today).

China likely moved the RMB up versus the US dollar to endear itself to global investors, particularly central banks, as China is mounting a full-scale effort to make the RMB an emerging reserve currency and present itself as an island of stability while the US is undergoing social, political, and economic turmoil.

China’s Emerging Currency Bloc

Several other countries’ currencies in Asia also notably traded decisively on the rise of social discontent starting on May 27th – Korea, Philippines, Malaysia, and Taiwan.

Perhaps what is most surprising is that Korea and Taiwan are key allies of the United States in Asia. Moreover, the Trump Administration just recommended three major arms sales to Taiwan. In addition, the Philippines just reversed a decision to be closer with China and reaffirmed their alliance with the United Sates.

The RMB turned on a dime on May 27th - the death of George Floyd

As did the Korean won - which wouldn’t be enough of a signal by itself…

You see that Taiwan sold off too.

Even the Malaysian ringgit broke down suddenly.

As did the Philippine peso - rounding out the bloc.

Too Big to Join

Countries who are too big to be influenced by China and are not a part of this possible currency bloc are India, Japan, Australia, and Indonesia – their currencies have not traded from this news.

Black Hole Gravity

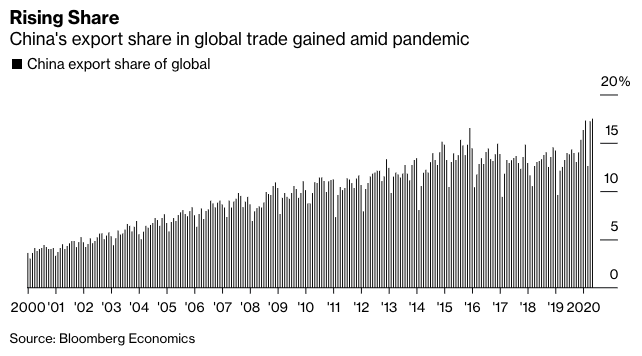

China’s sheer volume of trade will, like the power of a gravity from a black hole, simply pull its local trading partners into its sphere of influence.

While much has been made of the South China Sea freedom of navigation, maritime boundaries and natural resources, and brawls between China and India – the reality is that China may be creating a de facto currency bloc through trade.

As the pull of trade is so great, particularly for mercantilist Asian states, that they are bound to become quite close together – even though the United States has substantial military commitments to Korea and Taiwan.

Global Power Dynamics

We are living in a very competitive, complex world. The yuan’s appreciation was a smart move by the Chinese government to make the yuan look desirable while the US is turned upside down.

The rise of what appears to be an emerging currency bloc dominated by China is an excellent example of how markets can provide clear signals of political strategy being implemented, in real time.

I am surprised that the currencies of trading partners are starting to trade and take their cue from China’s yuan. If this continues, then we ate starting to see the rise of a new, albeit informal, greater China currency bloc. This is likely a new global power dynamic taking shape.

As Michael Pettis, a noted China scholar was quoted in CNBC on September 4th, “I continue to be very skeptical about any dramatic rise in the RMB as a major reserve currency. The extent of the adjustment China must make in order to rebalance the sources of demand in its economy is substantial, and every one of the historical precedents suggests that the adjustment will involve a transformation of economic (and perhaps political) institutions.”

Therefore, China may fail in its bid to transform its own internal political systems. Or, conversely, through the world of modern trade, perhaps China may be externalizing part of its institutional development through a regional currency bloc?

This is a tentative theory of change and I am not sure if it makes sense yet. But, I feel that it offers path to provide insights into a complex process that is underway.