Is George Floyd’s Death Killing the Dollar?

greg beier macroESG.com 10 june 2020 11:30 pm new york

Subscribe to the Macro ESG Podcast: Apple Spotify Google Anchor links to other providers

As clearly seen on the US Dollar Index chart, Mr. Floyd’s death on May 25th (plus the domestic and international protests it triggered) sparked a remarkably clear decline in the US dollar. The stunning call by President Trump on June 1st for the military to “dominate” America’s streets became even more astonishing when Secretary of Defense Esper declined his request the next day.

These developments are putting the US dollar’s institutional credibility at risk - exactly when trade and fiscal deficits are accelerating. Moreover, the OECD announced today that the negotiations on a digital sales tax are faltering and could result in the US getting into a global trade war with multiple countries.

America’s standing has gone down a peg which can be restated to mean America’s sovereign ESG risk is rising. As America is the ballast of the global system, this also means that global financial system risk is increasing too. Hence, the EIU’s global risk chart in yesterday’s piece.

So what does this mean for markets?

My first thought when I saw the decline is that this is bad for equities. Since 2008 financial crisis, the dollar has been generally up – because the world believes in the US. But the USD rally off the 2018 low has not surpassed the brief high following Donald Trump’s election and the surprise equity rally. In other words, the USD – as measured by the Dollar Index – is making a lower high while equities are making a new high. This is a negative confirmation. I would have expected both to have gone up together.

The dollar is making a lower high while US equities soar to new levels - a bearish divergence.

The US Dollar and Recent Presidents

-

Under George W. Bush, the Dollar Index decline from about 120 to 72 – ending in a calamitous bust.

-

Under Barak Obama, the dollar moved up from 72 to 102, making up for about 60% of the decline in value from the Bush 2 era.

-

Under Donald Trump, the dollar sold off from 102 to 90, and tried to get back to the old high – but it hasn’t worked. Apart from the flight to safety spike where the dollar was exceptionally strong for a few days, the dollar could be telling everyone – it’s time to roll over.

Emerging Markets FX Bust?

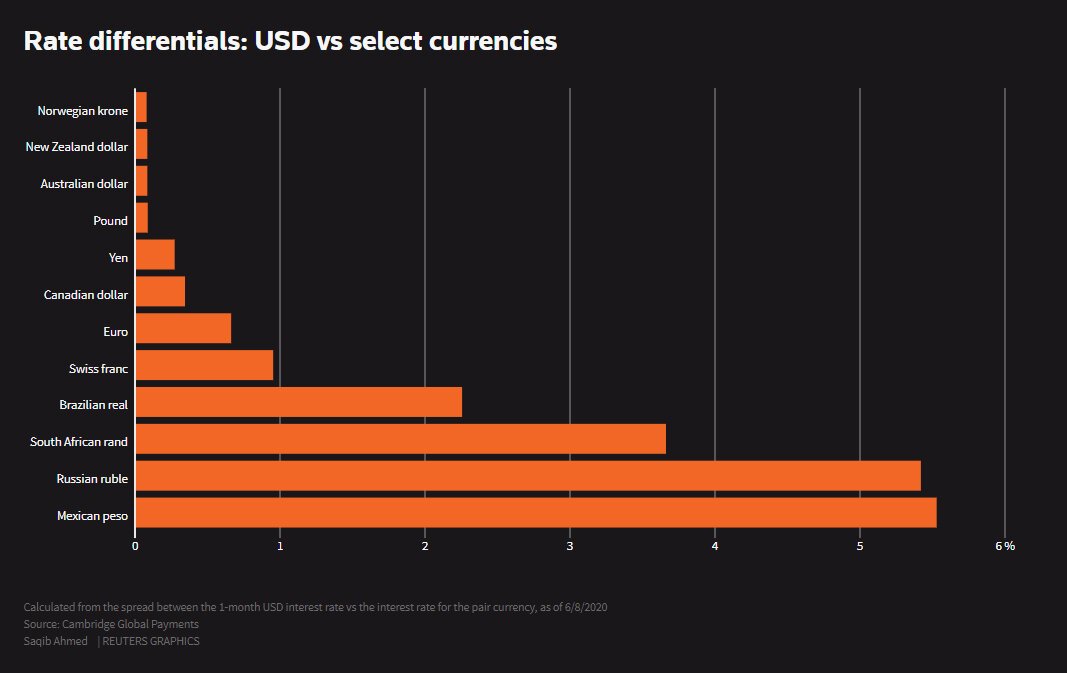

Alternatively, a second wave of the virus could push the dollar back up quickly in a standard flight to safety and then the dollar could tank again. This would create havoc in the emerging market currencies as many are deep in carry trades - big, wide whipsaws are lethal.

Digital Sales Tax

I believe that the US is making a mistake pressing its partners too hard on the digital sales tax. US technology companies have literally reshaped the world over the past 15 years, in large part because most of the world has a great deal of trust in the US and its institutions.

The US made a mistake by not endorsing and making GDPR a global standard since the US is going to get the same place anyways. And the US is making a big mistake by not sharing in the revenue generated by super dominant US tech companies.

America is getting into a trade war that it should not be fighting over digital revenue streams. America needs its allies right now, especially so late into an equity market cycle with the dollar weakening.

Brazil

The New York Times reported today that talk of the military taking over the government and ending democracy there is being openly bandied about, including by President Bolsonaro’s own son. Trump and Bolsonaro rose together - and - will they fall together?

Conclusion

While George Floyd may have died on a street and sparked protests at home and around the world, what really might have happened is that people’s perceptions of the US as a reliable partner – a global leader – might be called into question as much because the death happened the way it did – but also because of the way the US public responded to it with such vehement protests and the way the leadership in Washington responded to it so unbelievably badly.

Many folks around the world might be thinking – this is not the US that we believe in – and hit the RED SELL BUTTON on their Bloombergs.