Macro ESG Daily: We Are At an Inflection Point

greg beier macroESG.com thursday 23 july 2020 11:55 PM EDT

Subscribe to the Macro ESG Podcast: Apple Spotify Google Anchor links to other providers

Summary

-

We Are At an Inflection Point

-

The markets today are on a knife edge. The whole lattice of politics, elections, technology conflicts, China, and virus can be seen clearly in the trading of the USD, the SP500, the Nasdaq, crude oil, and the 30-year yield.

-

Disaster could be averted, but the flow of bad news a-la the virus is so negative and not likely to diminish that it looks like the whole system is about to roll over.

Macro – Markets, Politics, & Technology

Markets

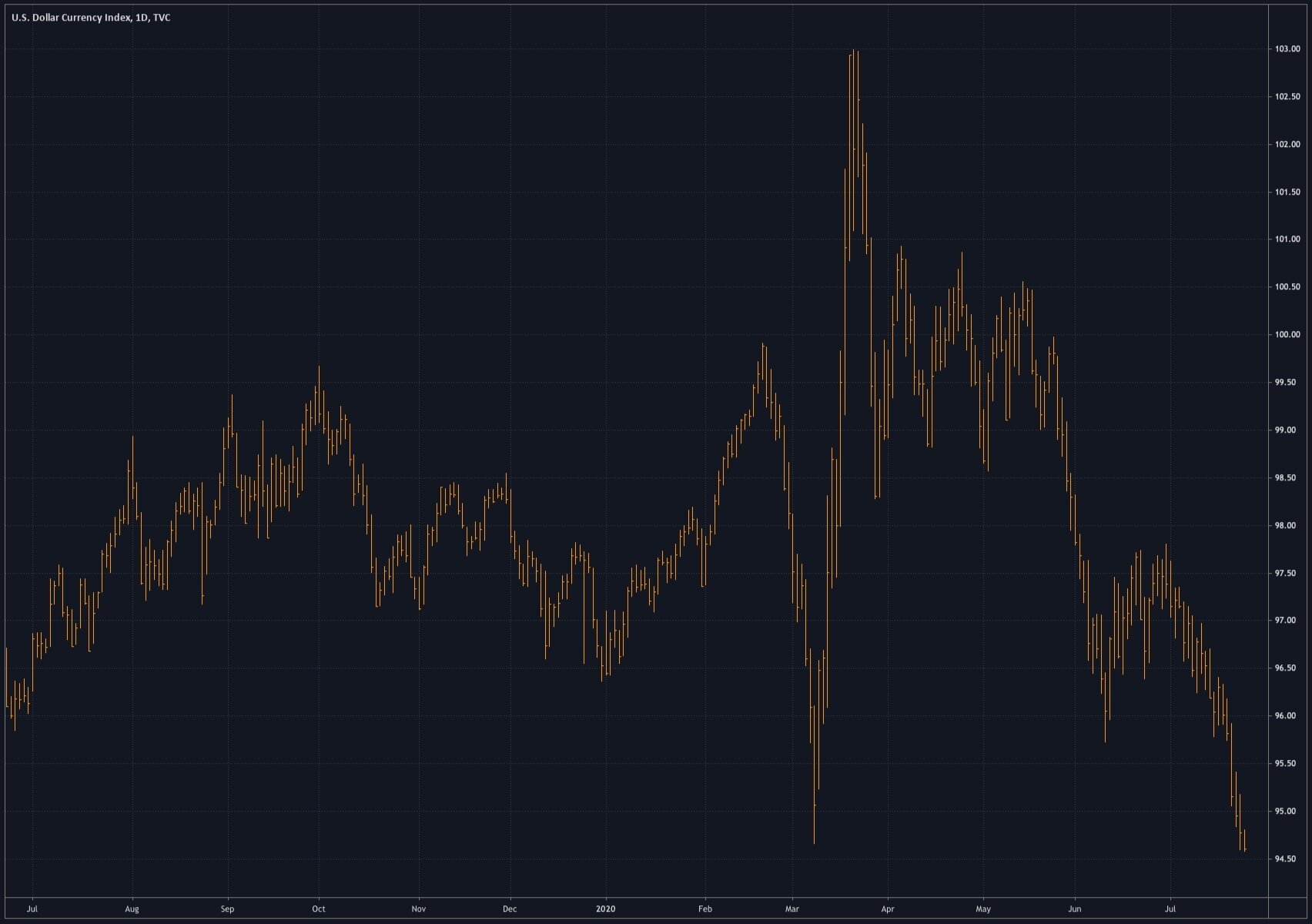

DXY: Today, the Dollar Index traded below the March low without a wave of terror running blatantly through the markets. This means that the DXY has a lot more run to go before sentiment hits an extreme, triggering a snap back.

SP500: The SPX had a hard sell off which took the leadership down.

Nasdaq: Today’s sell-off in the Nasdaq was decisive enough to signal a turn around.

Brent Crude Oil: Brent just started to roll over with the other so-called “risk-on” markets. That’s true but it’s also going to soften up as the Americans bring fracking back online after the rout this spring. The Russians and the Saudis are in prime position to knock this market out and make the US recession far more painful.

30-Year US Treasury Yield: The good old Long Bond is the only market that can still trade with any kind price signal. And today’s drop in line with crude, the equity indices, and the dollar signals that investors might drive this market to a new low yield. Maybe it goes to zero yield as a sign of the market bottom?

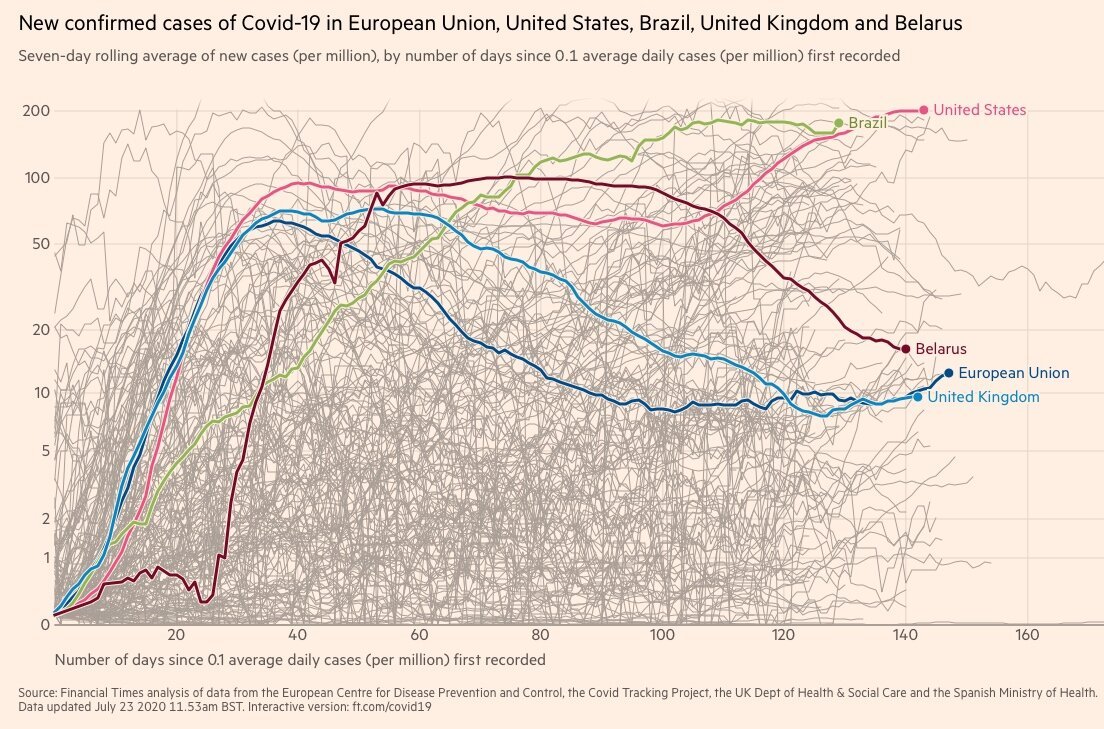

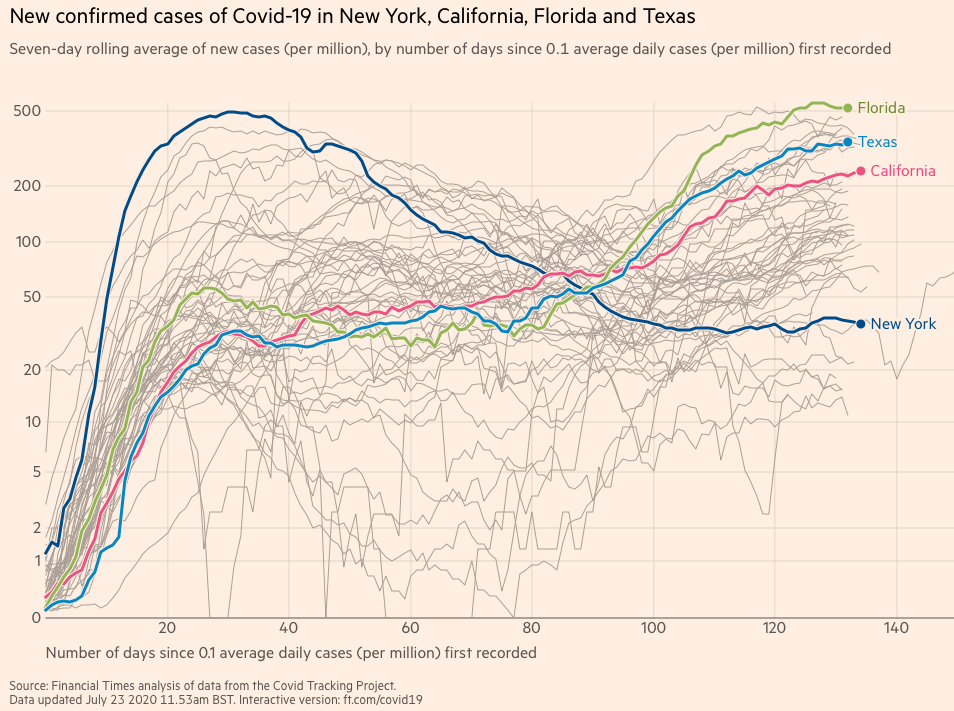

Virus Charts: Though not a market per se, it is the inflection point for the market. The data is simply getting bad and worryingly I am noticing that that the EU, the UK, and even Brazil snapped back.

Politics

Republican Convention: Cancelled. That about says all one needs to hear about the Trump campaign, which is also basically cancelled as it is now trailing by 14 points in Florida - an absolutely crucial swing state.

Stimulus Bill: Reports are coming in that the stimulus bill is getting hung up. The more the Republicans hold this up after years of generous tax breaks that nobody wanted but gladly took, the political situation is starting to clearly indicate that the Senate is going to fall to the Democrats too. It’s going to be a political Armageddon.

Hong Kong: China announced that it might not accept British National Overseas passports so the people might not be able to leave. Have we just returned to the old era of communism when these states kept their people hostage? Will Hong Kongers become boat people? Such a travesty for one of the world’s greatest cities.

Technology

Tesla: With Tesla close to being admitted to the SP500 according to the WSJ, I find that we are at an extreme. I love the Tesla Cybertruck, but I don’t think that Tesla at its current stratospheric valuation makes sense to be in the SP500. I think that it is a short - a monster short.

ESG – For a Sustainable Future

2-3 Key Skills: I received an interesting query today from a professor who’s going to be teaching an ESG investment course - what are the 2-3 key skills that the students need to bear in mind?

-

You have to look at the global power dynamics of markets, politics, and technology for a sustainable future.

-

Focus on your business and solve specific problems, but also take a minute to consider the very big picture every now and then and think about how these trends might affect what you are working on.

-

Develop a Macro ESG awareness.

Investment Opportunity

Overall Impression: The markets are setting up to roll-over. Today’s price action across major markets in conjunction with such significant news is one of those riveting moments when things start to line up. We are not quite there, to say let’s hit the go button - almost.

Global macro is going to have a banner year, maybe even a banner decade.