Unifying Systemic and Exogenous Risk Analysis

greg beier macroESG.com 11 may 2020 22:00 gmt

I had the chance today to speak with friends about Macro ESG and the questions they asked prompted a bit more of an explanation of the ambition of Macro ESG.

Future Posts

But, before I get into that, unless any unexpected risk analysis comes up, on Tuesday I will start with updating the oil market analysis, Wednesday will be the analysis of incentives behind poor testing in the US which prompted the economic and market bust, and Thursday I will get into what I call the Harvard Sell Signal, which is actually a very bullish story for the United States and the world generally.

Structure of Macro ESG Analysis

Macro ESG begins with an analysis of markets, politics, and technology for a sustainable future. Markets, politics, and technology are the principle drivers of change today, I believe, and then once you make your view big enough, a sustainable future become an automatic consideration.

From this analysis, if you do it well in enough scenarios, one begins to see clear power dynamics that are at play. And, if you seriously consider the sustainable future question, this naturally includes planetary systems and their respective boundaries, then we have an emerging methodology for unifying the analysis of systemic and exogenous risks to be applied in an investment setting. I have to say that is exciting to me.

Holistic Power

Perhaps a larger ambition of Macro ESG is to build a holistic view of the world based on understanding power that people in power can understand and respond to. But, as I made clear in the first post, I do believe that we are going to a point of broad international cooperation. It’s simply going to take a crisis - or a collection of crises - that sufficiently move enough powerful stakeholders far enough away from their preferred positions before they begin to cooperate.

That is the “ah-hah” moment when the United Nations Sustainable Development Goals will seriously be implemented. But, there is a risk that I worry about. Markets and politics, and to a lesser extent technology, these are man-made risks which we can change quite readily, almost in a flash, like the Berlin Wall coming down. Markets and politics are workable. Technology starts getting risky when weaponized, but is generally workable too. The risk that I worry about is exceeding a tipping point, a natural boundary, which knocks us out.

Macro ESG Means Interconnected

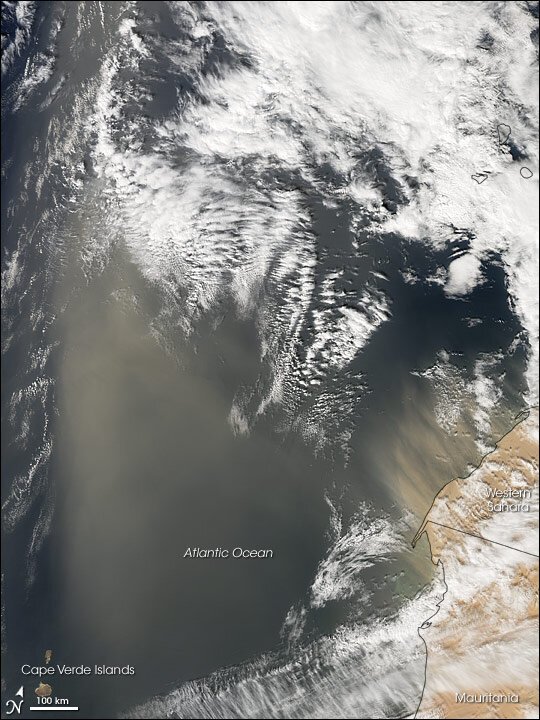

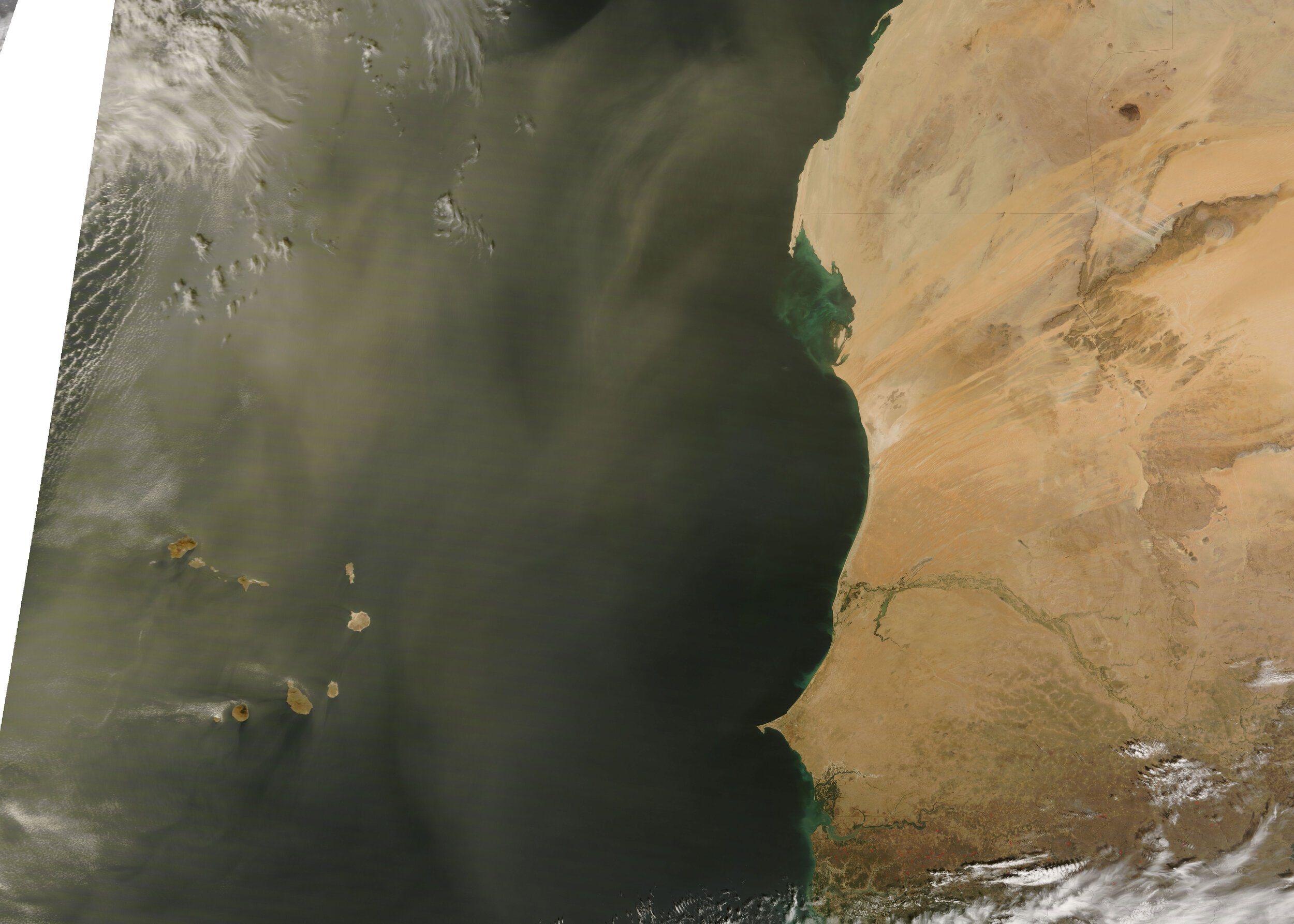

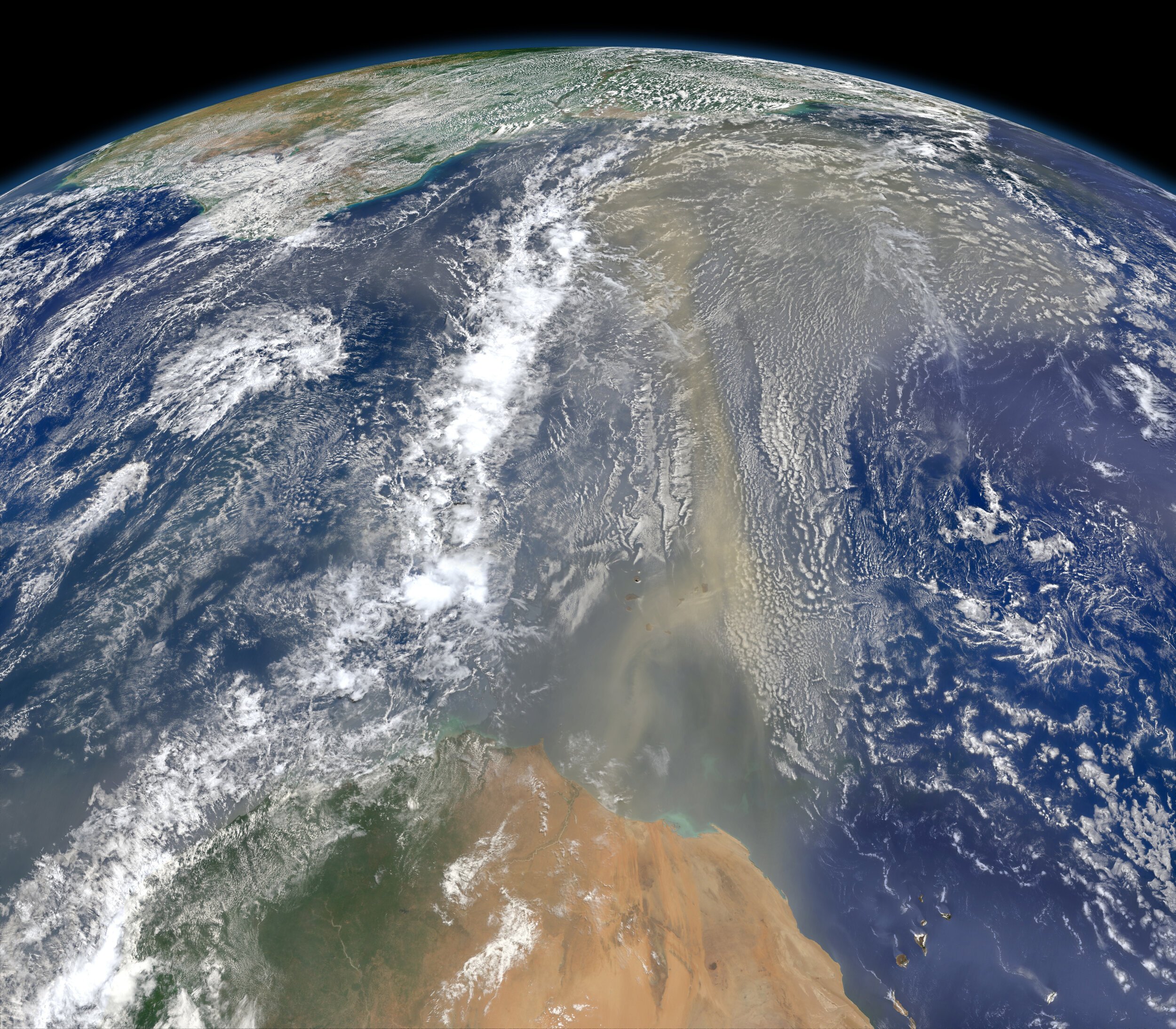

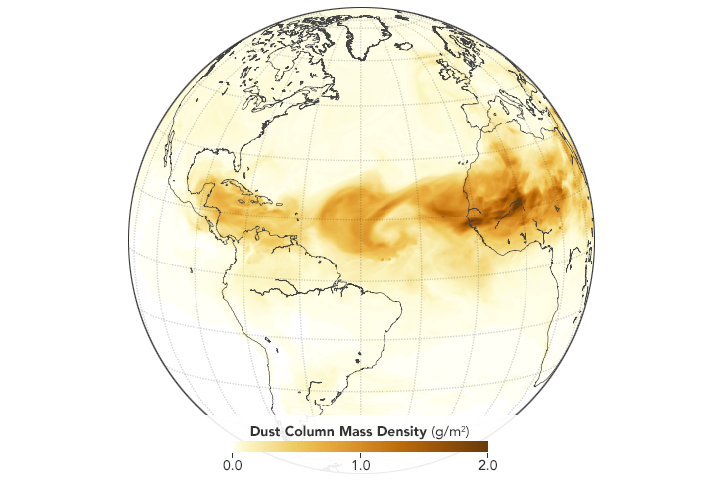

Macro ESG is really about how interconnected we all are and nothing beats NASA images to make the point! These images of dust clouds below being blown to the Western Hemisphere from the Sahara Desert are metaphorical of global power dynamics at work. The key is to take a planetary open-minded perspective and just see things as they are.