Ideas – Buy Deep Out of the Money One Year Puts in Size on US Equity Indices, Delta Variant Risk Up

Gregory C. Beier

Macro ESG Strategist

Sustainability Arbitrage LLC

Wednesday, June 30, 2021 04:49 AM EDT

Subscribe to the Podcast: Apple Spotify Google Anchor links to other providers.

Please be sure to sign up for the newsletter below.

Ideas – Buy Deep Out of the Money One Year Puts in Size on US Equity Indices, Delta Variant Risk Up

The Australian government initiated a strict two-week lockdown in Sydney this week and its news service laid bare the significant risks of the Delta Variant, implying a much higher risk than is being made clear by governments in Western Europe or the US. We believe the Australian report to be solid as they have a very open, cohesive society.

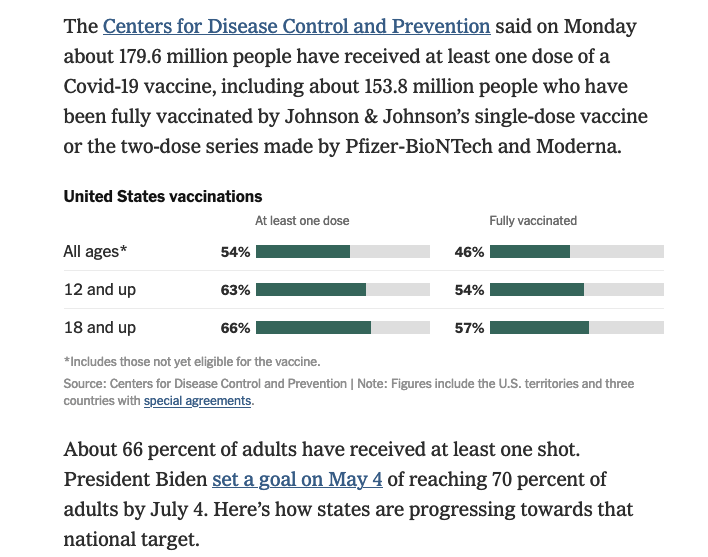

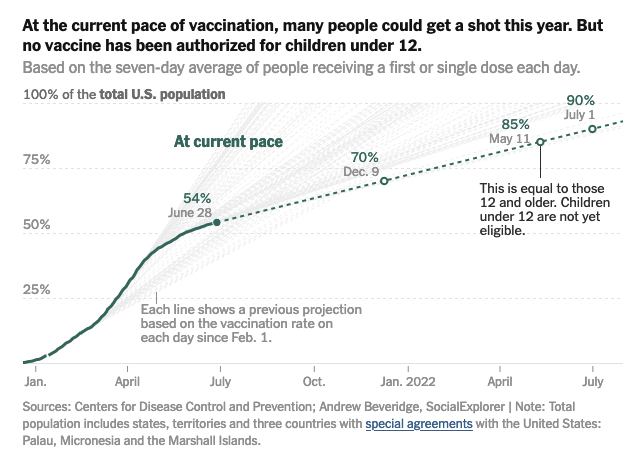

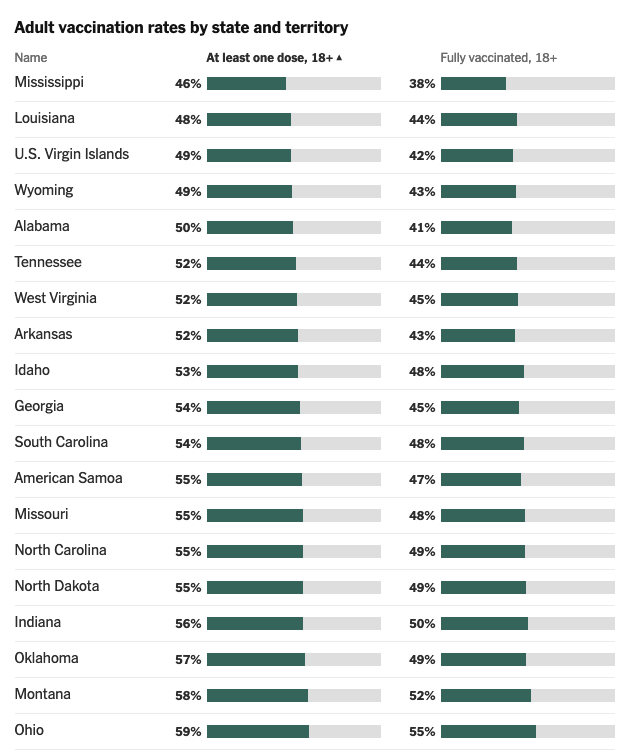

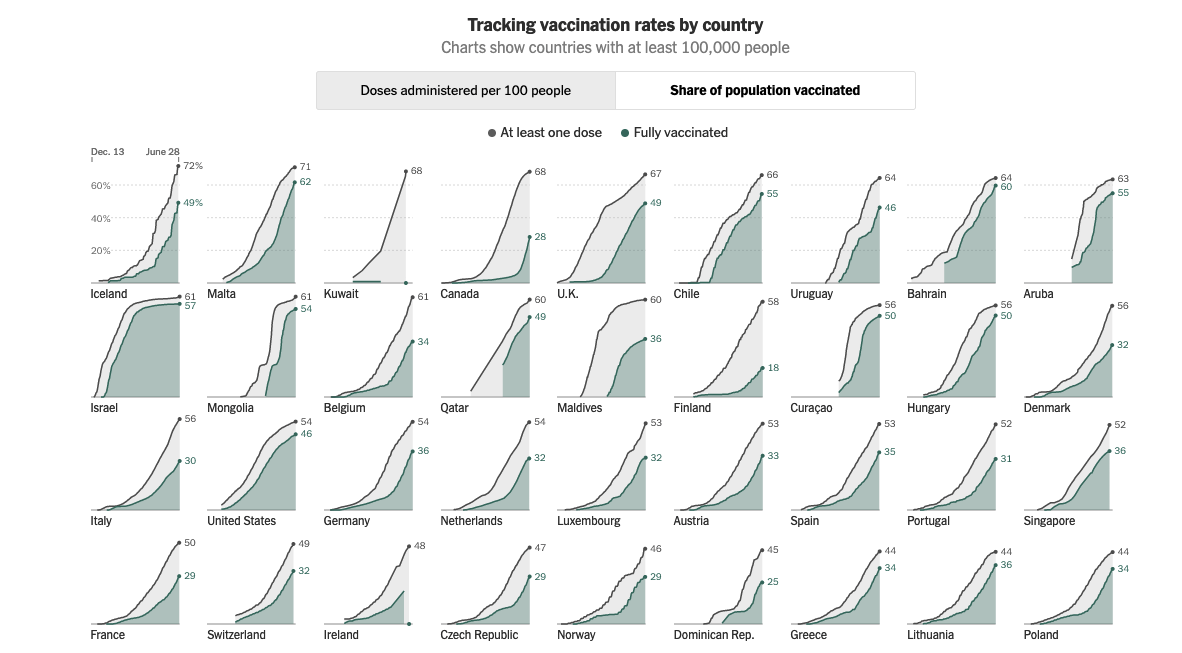

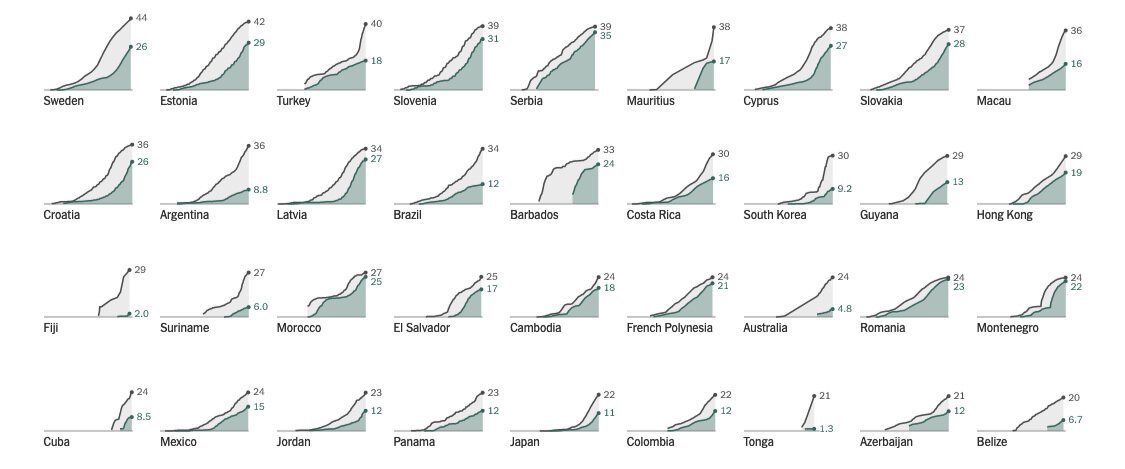

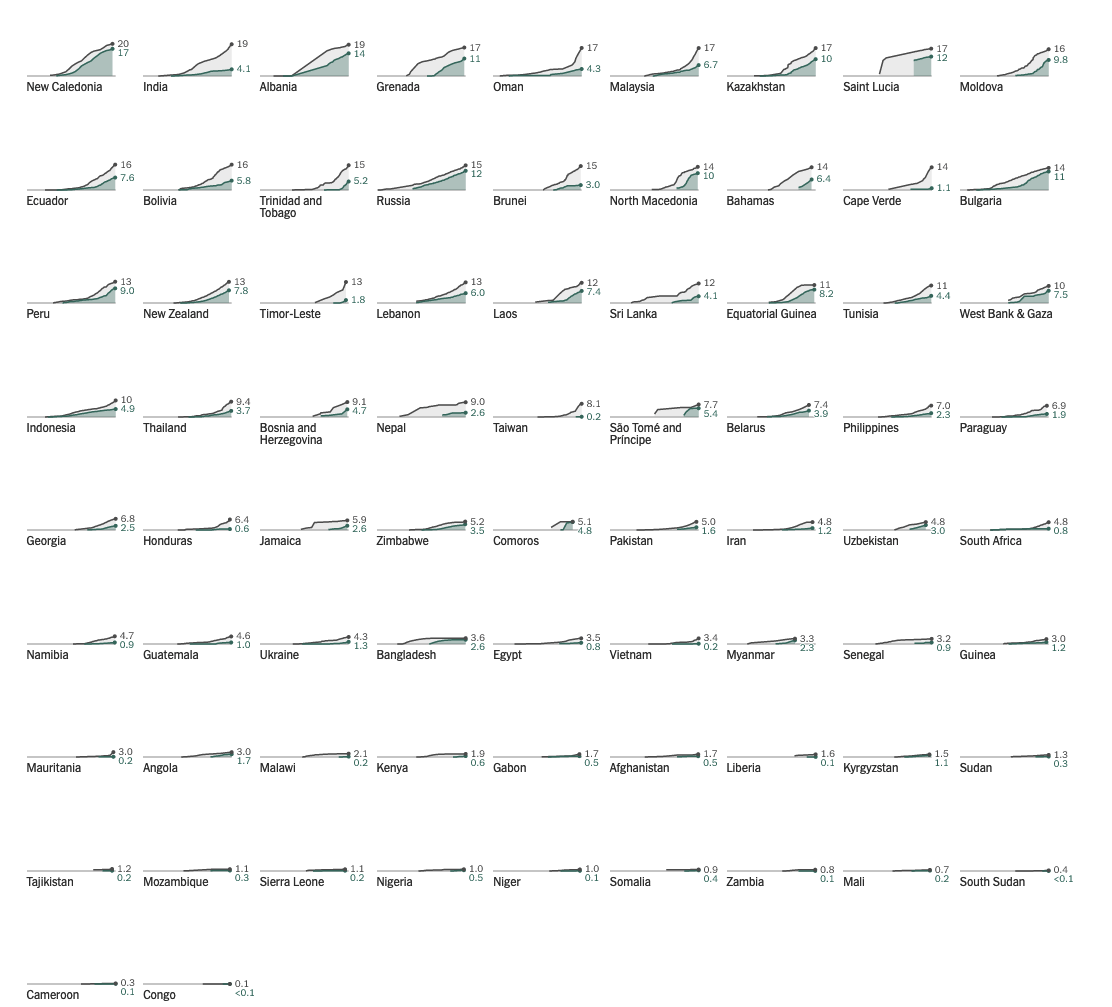

The exceptionally transmissible Delta Variant is likely to infect everyone until communities hit a population immunity threshold of vaccinated or previously infected. In the United States, 54% of all Americans have had one dose and 46% are fully vaccinated; worryingly, 17 states have first-dose vaccination rates below 50% among 18-year old’s and up. Globally, only 39 countries report having vaccinated more than 40% of their population.

54% of all Americans have had one dose and 46% are fully vaccinated. Source: NY Times

Not a good picture. Source: NY Times

17 states have first-dose vaccination rates below 50% among 18-year old’s and up. Source: NY Times

Globally, only 39 countries report having vaccinated more than 40% of their population. Source: NY Times

The uneven, slow roll-out of vaccinations in the United States and across the world mean that people are going to have to get sick to achieve herd immunity in their communities or they will have to lockdown and wait to get vaccinated. The result is that large parts of America and entire countries will likely have lock downs from the Delta Variant, surges of illness, or mixes of both. The more people the virus infects in different settings, the greater the chance that dangerous new variants arise which current immunities are not effective against.

Governments, central banks, and markets will find anticipating and managing these rolling crises problematic. These and other risks described in earlier Macro ESG pieces are quite likely to overwhelm monetarily stimulated stock markets.

Consequently, Macro ESG went inordinately short US equities today (June 29th) through large purchases of deep out of the money one-year puts on US Equity Indices in the Leveraged Aggressive Model Portfolio.

Analysis:

1. Delta Variant Risk Up

The Australian experience with the Delta Variant is succinctly covered in a television news report by the Australian Broadcast Corporation on Monday, June 28. Highlights of the exceptional risk profile of the Delta Variant include:

-

“At a Southwestern Sydney birthday party, 24 out of 30 guests have been infected – the only people who weren’t infected were six people who were vaccinated”

-

“We are seeing almost 100% transmission within households.”

-

“It is thought that 1 infected person (with the Delta Variant) can spread to six others, compared to just over 2 with the original Wuhan virus.”

-

“The rapid spread of this variant can mostly be explained by how efficiently it attaches itself to healthy lung cells. The spike is capable of attaching more readily, more capable of introducing the virus and infecting cells, …it’s capable of producing slightly more virus within the lung cells.”

-

“For each week of delay, it infects about 5 times more people.”

-

“The other feature of this New South Wales outbreak is that it is infecting children… It may be finding a gap in community vaccination.”

-

“It is almost exclusively, though not entirely, infecting those around the 20-29 age bracket.”

-

“It’s slower to announce its symptoms…the asymptomatic period is longer...”

2. Five - Ten Seconds Transmissibility

The Guardian reports, “Based on CCTV footage, health officials suspect it has been transmitted in “scarily fleeting” encounters of roughly five to 10 seconds between people walking past each other in an indoor shopping area in Sydney in at least two instances.”

The Guardian further reports, “The variant, first detected in India, has been identified in at least 92 countries and is considered the “fittest” variant yet of the virus that causes Covid-19, with its enhanced ability to prey on the vulnerable – particularly in places with low vaccination rates.”

3. The Viral Bomb Goes Off

Only 27 countries have first dose vaccination levels above 50%; all rich nations aligned with prosperous Western democracies.

As summer travel picks up this year and global trade rebounds to pre-pandemic levels, the circulation of people will support the spread of the Delta Variant around the world, creating more variants – some which could be more dangerous than the Delta Variant.

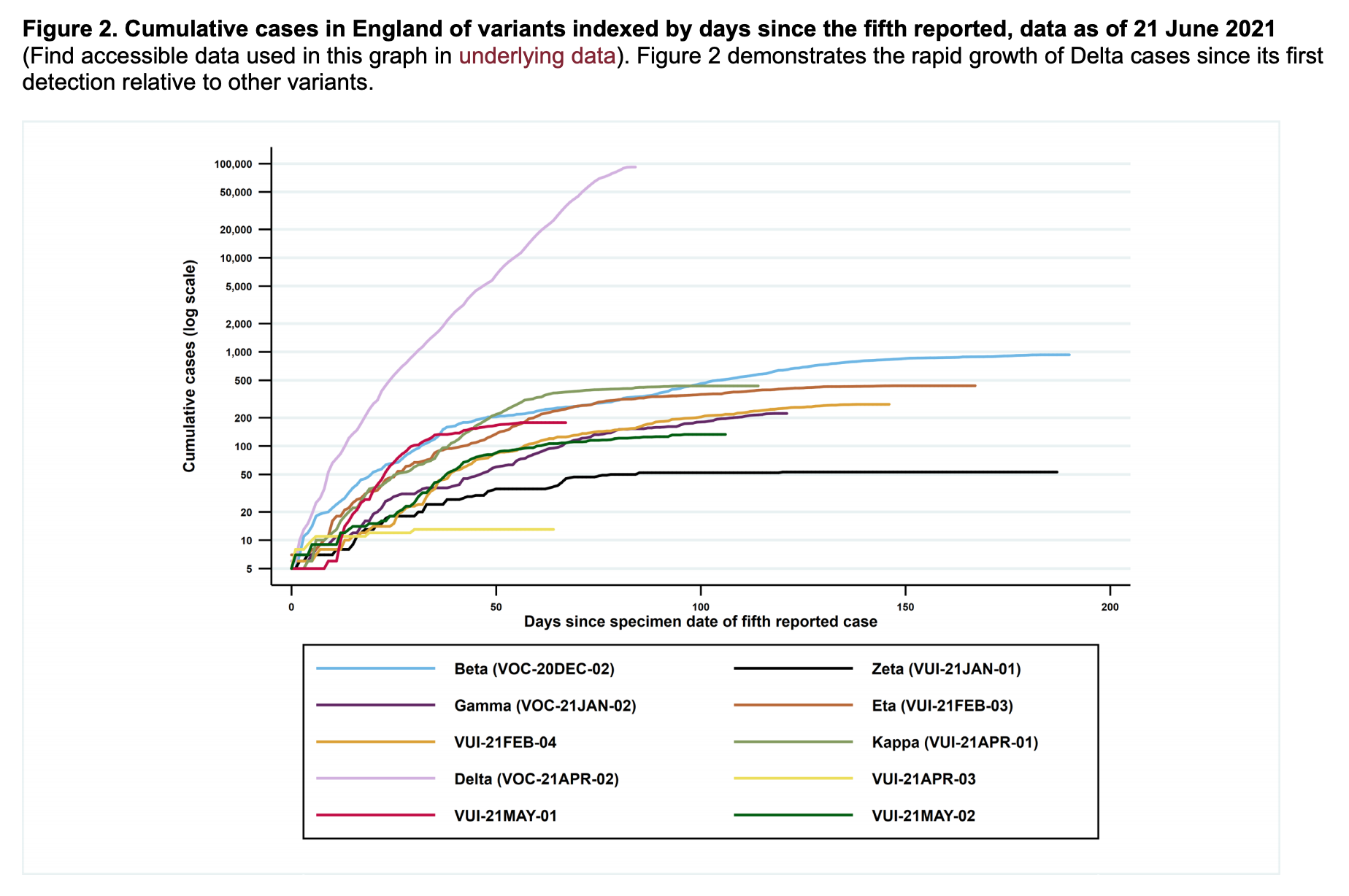

The Delta Variant is an altogether new level of virus. Source: UK Government, Variants of Concern, Technical Briefing 17

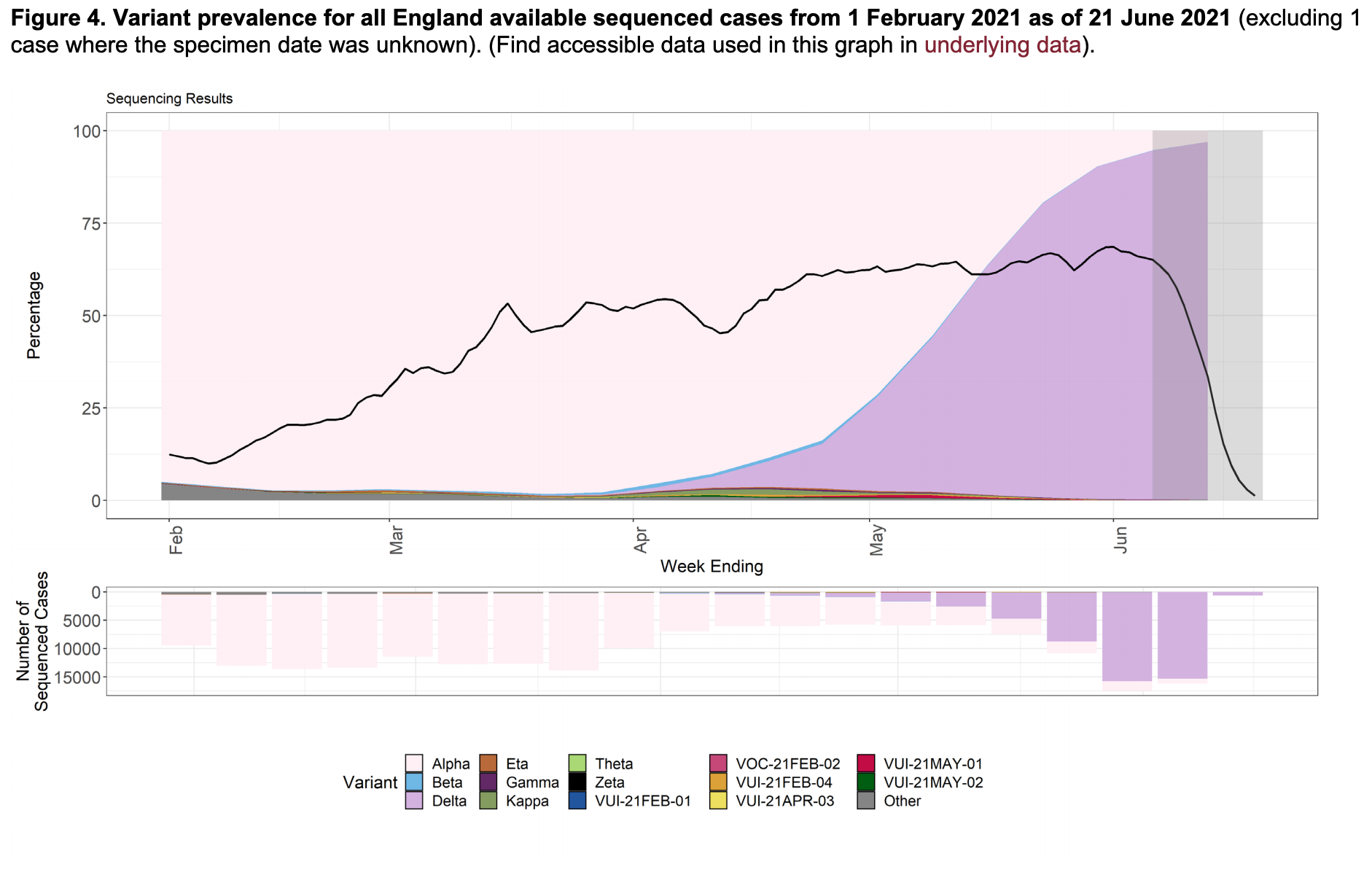

The Delta Variant conquered the UK in two months. Source: UK Government, Variants of Concern, Technical Briefing 17

4. Lockdowns March West

Lockdowns are starting in Asia with Australia and Malaysia – it’s only a matter of time before it hits Europe and then the United States. With so few people vaccinated, there is nothing to stop it.

Not much to stop it here. Source: NY Times

Nothing at all to stop it here. Source: NY Times

5. America’s Contiguous Virus Zone

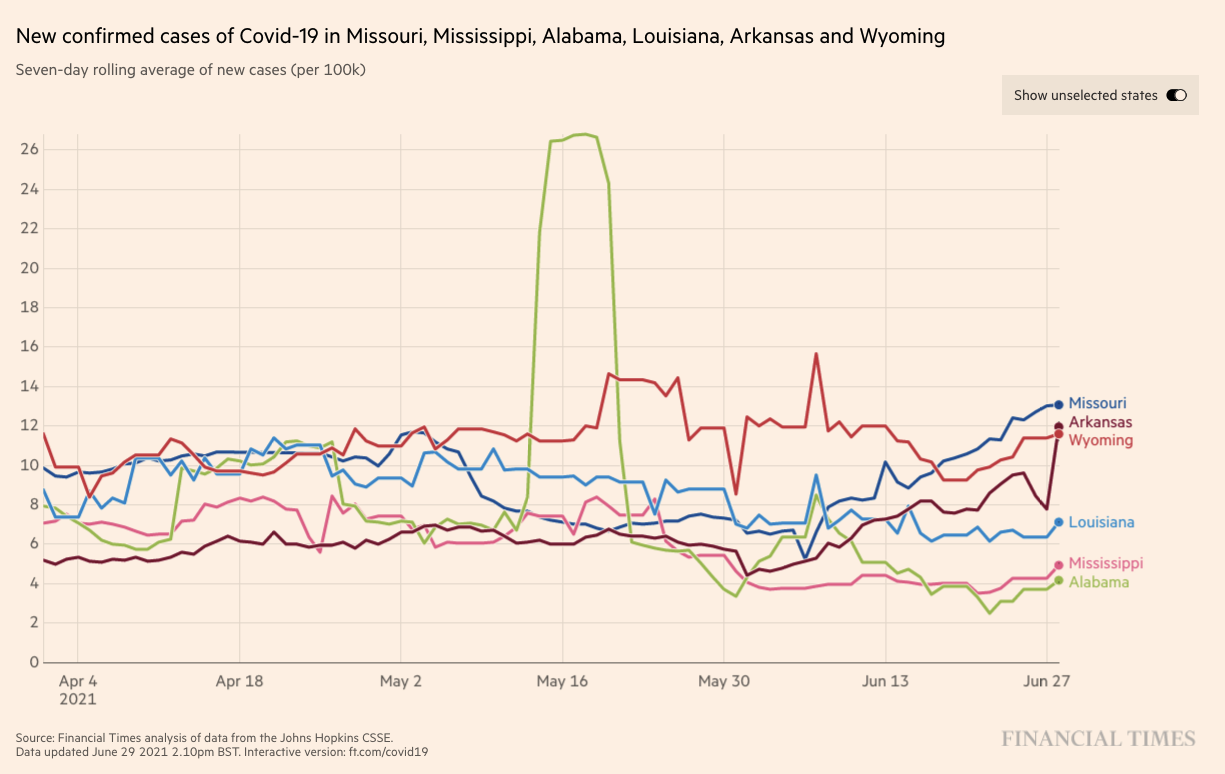

Low vaccination rates are concentrated in the South and Midwest of the United States. This will likely enhance the network effect of the Delta Variant spreading and concomitantly overwhelm the hospital systems in these areas, particularly as many rural hospitals have closed or operate with reduced capacity.

Are they already starting to respond to the Delta Variant? Source: Financial Times

6. Mother Nature Always Wins

This principle is really the heart of Macro ESG analysis. By far, without absolutely any comparison, the greatest risks that we face today are a world of climate change and biodiversity loss. And we clearly see that the pandemic is tied to the way the modern world operates, greatly enhancing the rate of spread and mutation, and the colossal political and business failure to respond to this pandemic with a global vaccine effort that will eventually hurt everyone.

So, when we came across the Delta Variant report from Australia on late Monday night East Coast time, it was perfectly clear to us that we needed to put on a large options trade (and we are not options experts) to ride out this decline.

Macro ESG is just being intellectually honest about risk and reward.

Strategy:

Long Term Model Portfolio

100% T-Bills

Leveraged Aggressive Model Portfolio

30% Short US Equities (On a Base $1,000,000 Portfolio, Prices used are the Offer as of June 29, 2021)

Long 103 Russell 2000 RUT 950 Jun 2022 Puts @ 9.7

Long 60 SP500 SPX 2150 Jun 2022 Puts @ 16.6

Long 22 Nasdaq 100 NDX 7000 Jun 2022 Puts @ 45

70% T-Bills

Long-Only Unleveraged Model Portfolio

100% T-Bills

1. Performance

To date, all three of our short equity future trades have been stopped out in the Leveraged Aggressive Model Portfolio for a total loss of -1.27%. The remaining Model Portfolios are 100% T-bills.

2. Maximum Bearishness

Given the risk profile of the Delta Variant combined with our recent analysis below, our view that 2021 will be worse than 2020 is confirmed by the latest credible reports out of Sydney, London, and Tel Aviv which paint a devastating risk profile of the Delta Variant. We believe that the stock market will go down soon.

Ideas - Sell All US Equities Now, Decline Will be Worse than 2020 June 4, 2021

Ideas - Short Nasdaq 100 Futures on US 10 Year Yield Decline June 13, 2021

Ideas - Double Bubble Ending, Stock Markets Will Go Down June 20, 2021

3. New Position

Today, we went long one-year deep out-of-the-money put options on US equity indices in the Leveraged Aggressive Model Portfolio. The trade is equally sized between the Nasdaq 100, SP500, and Russell 2000. The strike for each of the puts is around the lows of 2020. We went out one year in case the market enters a slow protracted decline, like the 1974 bear market in US equities.

4. Trade Size

The Leveraged Aggressive Model Portfolio is risking 30% of its capital because the risk-reward is so compelling.