Ideas - Sell All US Equities Now, Decline Will be Worse than 2020

Gregory C. Beier

Macro ESG Strategist

Friday, June 4, 2021 03:28 AM EDT

Subscribe to the Podcast: Apple Spotify Google Anchor links to other providers.

Ideas - Sell All US Equities Now, Decline Will be Worse than 2020

Analysis:

1. COVID Risk Increasing

News of Covid success in the United States and UK is masking much bigger problems. News reports estimate that 30,000 people are dying a day in India. Covid is still spreading out across the developing world and Asia (Tokyo and Melbourne on lockdown).

2. Variant Risk Increasing

The risk of a super variant that current vaccines are ineffective against emerging from these hotspots is a realistic possibility and will drive down risk taking in markets. As 200 countries come together for the Olympics in Japan, a super variant could emerge from the Games, as a chief doctor has warned, begging the government to postpone the Games.

3. Republicans

As the Democrats have such a narrow margin of control in the Congress, the Republicans are highly incentivized to harm the economy and be generally disruptive so as to weaken support for President Biden’s policies and push voters to support the Republicans in the mid-term elections and take control of the House and then the Senate.

For example, just two days ago former National Security Advisor General Flynn talked up a coup, the Governor of Texas just signed a law that will limit abortions after six weeks, and Republican states across the US are limiting voting access.

4. USDCNH Strength

Recent RMB strength (which began with the death of George Floyd – please see Is George Floyd’s Death Killing the Dollar?) prompted China to tighten its reserve requirement ratio and got the US Treasury Secretary to hold talks with China’s Vice Premier.

China couldn’t be in a stronger position right now as it has been the only major economy during the pandemic to tighten interest rates, generate economic growth, and offer a real yield on its bonds. This is a significant negative for the United States and adds a unique, structural-risk element to the global power dynamics picture.

5. International Norms are Declining

From the downing of a civilian airliner over Belarus, to China repeatedly violating its neighbors’ airspace and maritime boundaries with commercial and military aircraft and ships, to regular ultra-large-scale hacking incidents against the US – it’s only a matter of time before Red Lines are crossed. The overall pattern in international relations is increasingly becoming less coherent. Something exceptional is likely to happen – either intentionally or not – and events may go much farther than anyone expects now.

6. Taiwan and China

If a malicious COVID variant returns that current vaccines cannot stop, then China may use the return of lockdowns across the global economy as an opening to take Taiwan by force – just as China used the same cover to absorb Hong Kong.

7. Monetary Tightening

Any monetary tightening can pop a bubble – even as innocuously as the ECB did when it stated on September 4, 2008 that it is reducing the collateral value of asset backed securities. The Fed’s recent statement on tapering from the April meeting is sufficient to start the tightening process.

Strategy:

Long Term Model Portfolio

100% T-Bills

Leveraged Aggressive Model Portfolio

Short 20% notional SP500 futures @ 4192, Stop @ 4257, Risk: 0.31%, Trade Target: 1817, Risk Reward Ratio: 1 to 37.7

Long-Only Unleveraged Model Portfolio

100% T-Bills

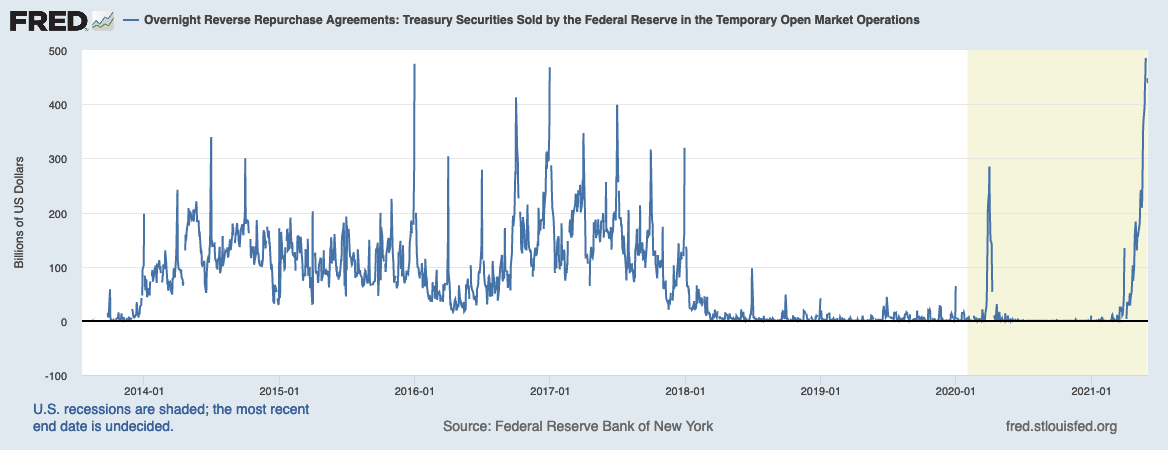

The recent surge in reverse repos may portend trouble.