SOCIAL MEDIA SHORT UPDATE

Gregory C. Beier

Macro ESG Strategist

Sustainability Arbitrage LLC

Tuesday, March 2, 2021 09:24 PM EST

Subscribe to the Macro ESG Podcast: Apple Spotify Google Anchor links to other providers.

Macro ESG = Markets, Politics, and Technology for a Sustainable Future

Summary

NB: This is an update to the January 12, 2021 piece “Social Media is a Solid Short.”

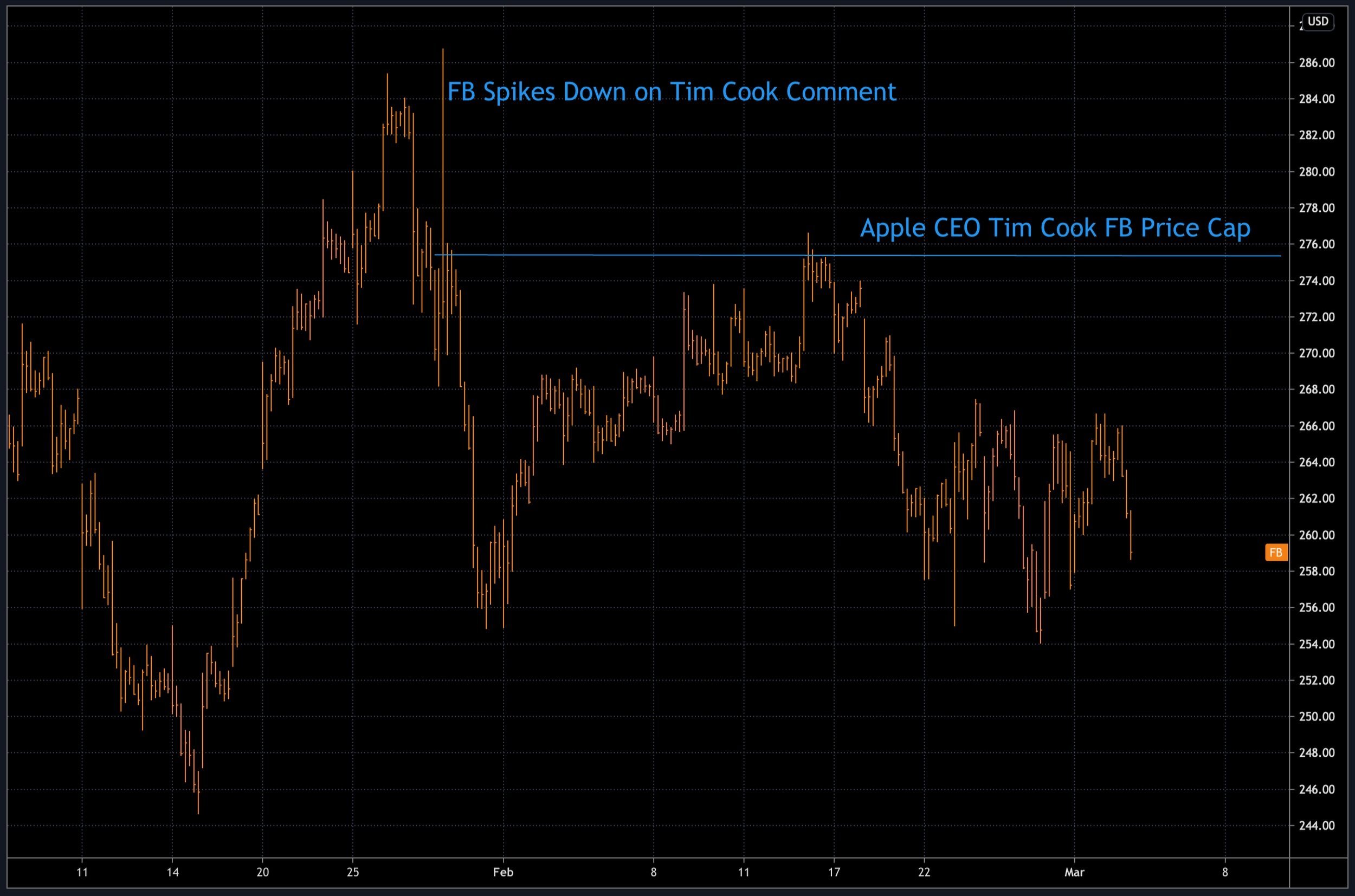

When Tim Cook, CEO of Apple, called out Facebook’s business model as being a social liability for humanity, he put a cap on the stock price.

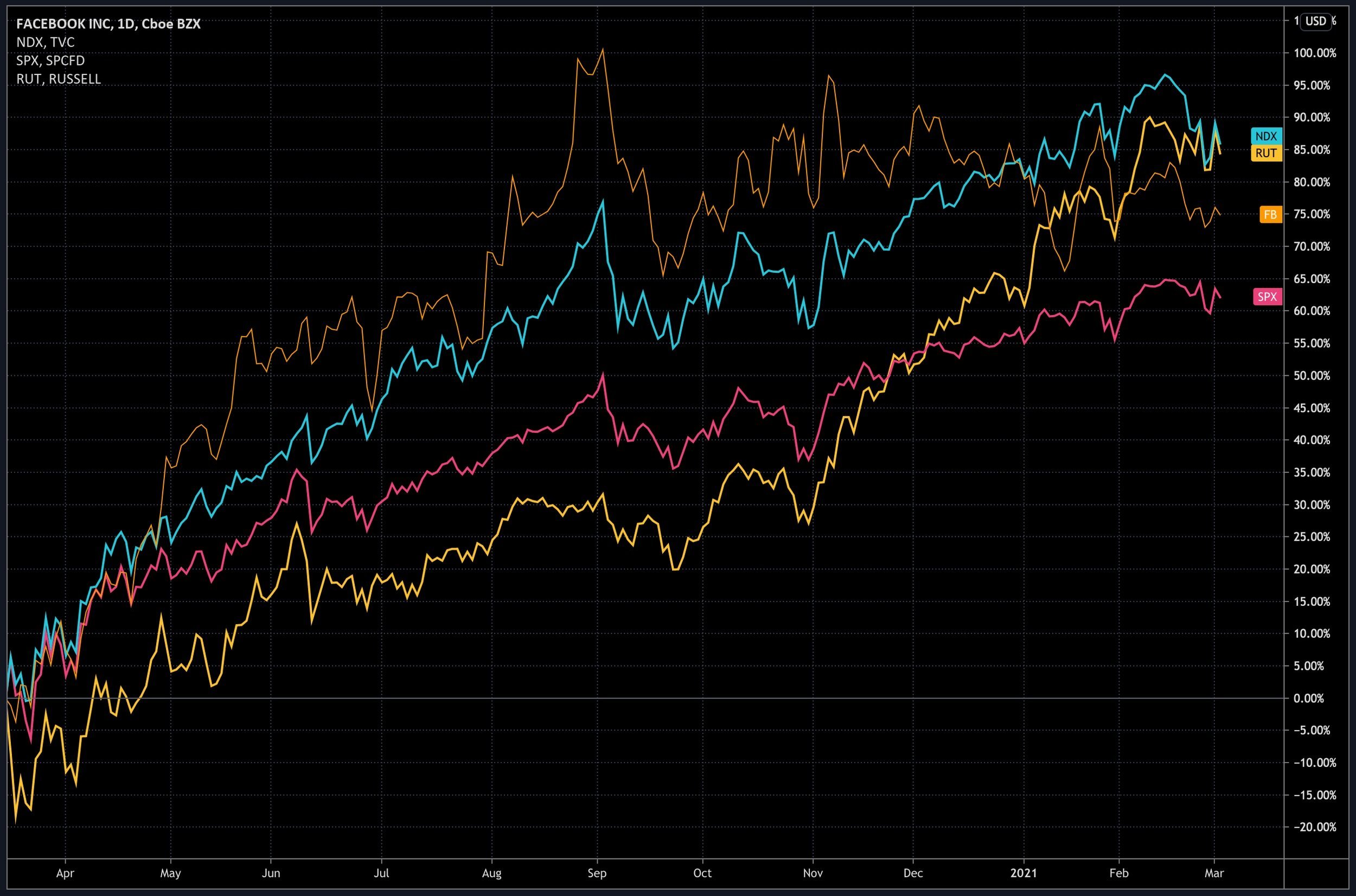

Blue Arrow Indicates Tim Cook Comment

-

Trade location: Facebook shorts should be made against the high of this day. While the market power is so substantial now, FB is gently listing along.

-

As the US congress and President Biden are tied up with vaccinating America and getting the stimulus program into law, this has kept the hammer of the government from coming down yet on social media while Australia led the challenge of the social media revenue model. If this were to happen across the world, Facebook’s near 40% profit margin on about $80 billion in revenue would shrink.

-

Jeff Bezos confirmed the negative outlook for mega-tech when he announced that he is stepping down as CEO to become Executive Chairman of Amazon, in a move almost certainly tied to the fact that the top job will become about managing regulatory risks like anti-trust, labor unions, and consumer privacy.

MACRO

Markets

-

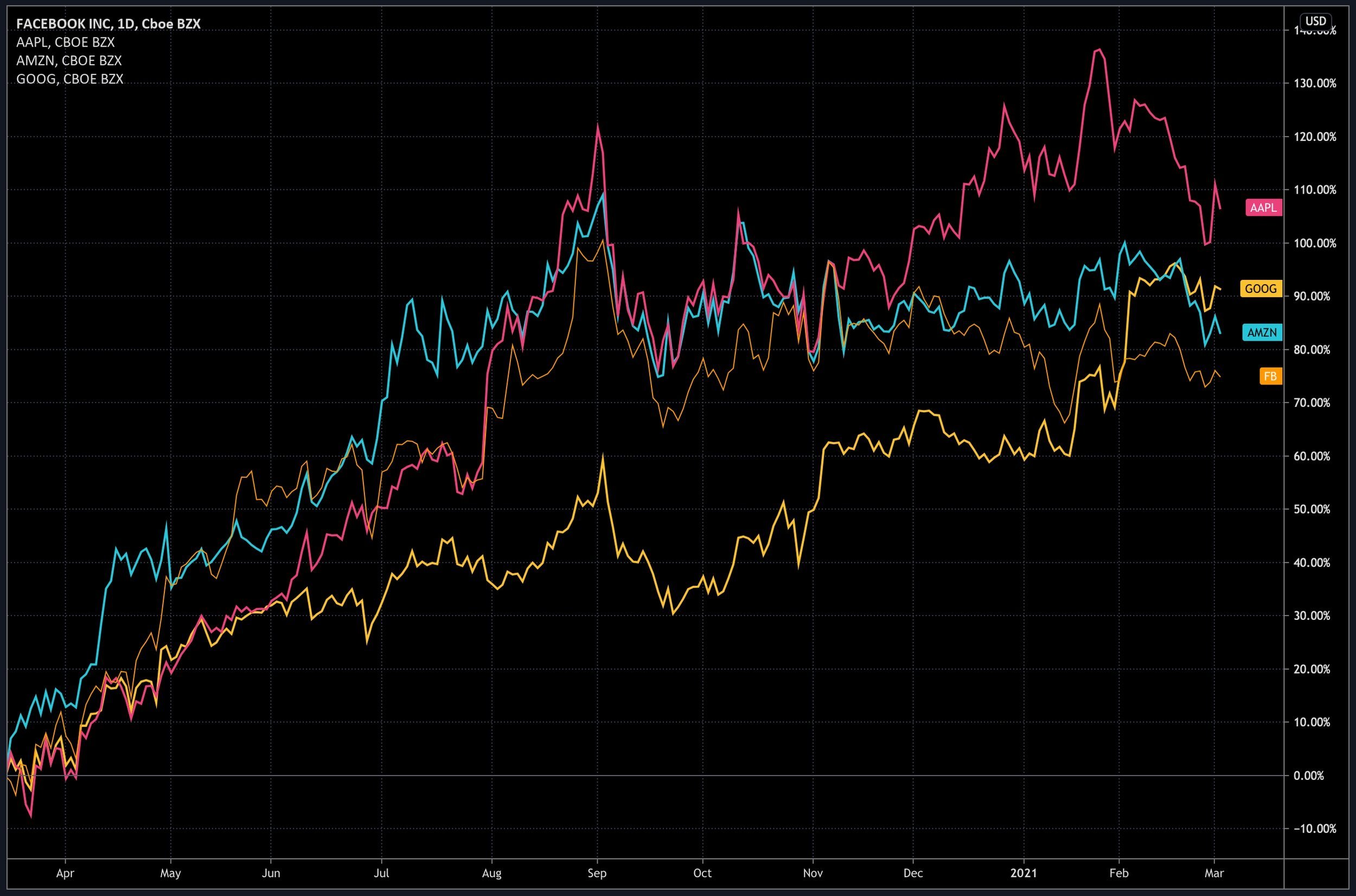

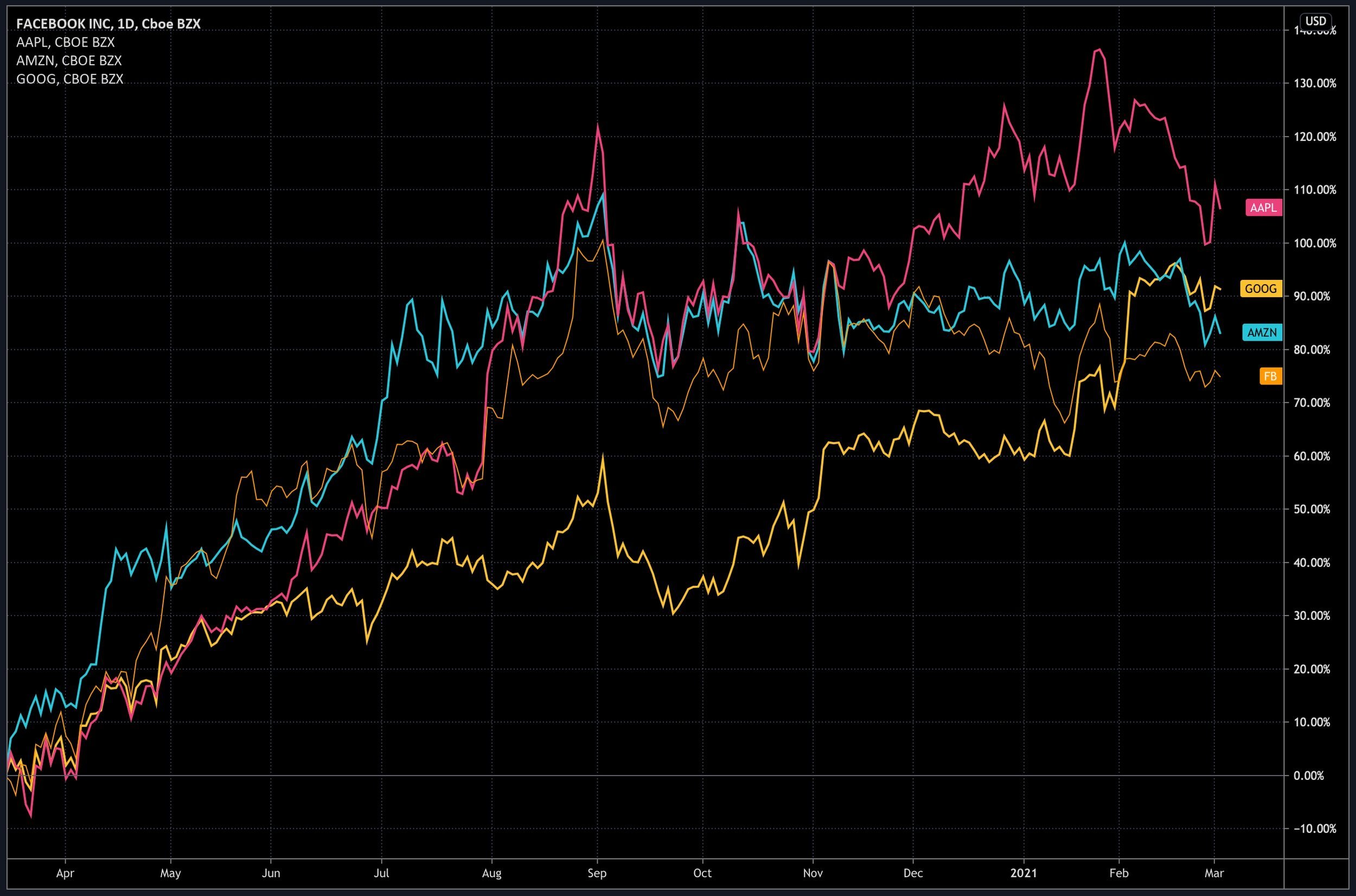

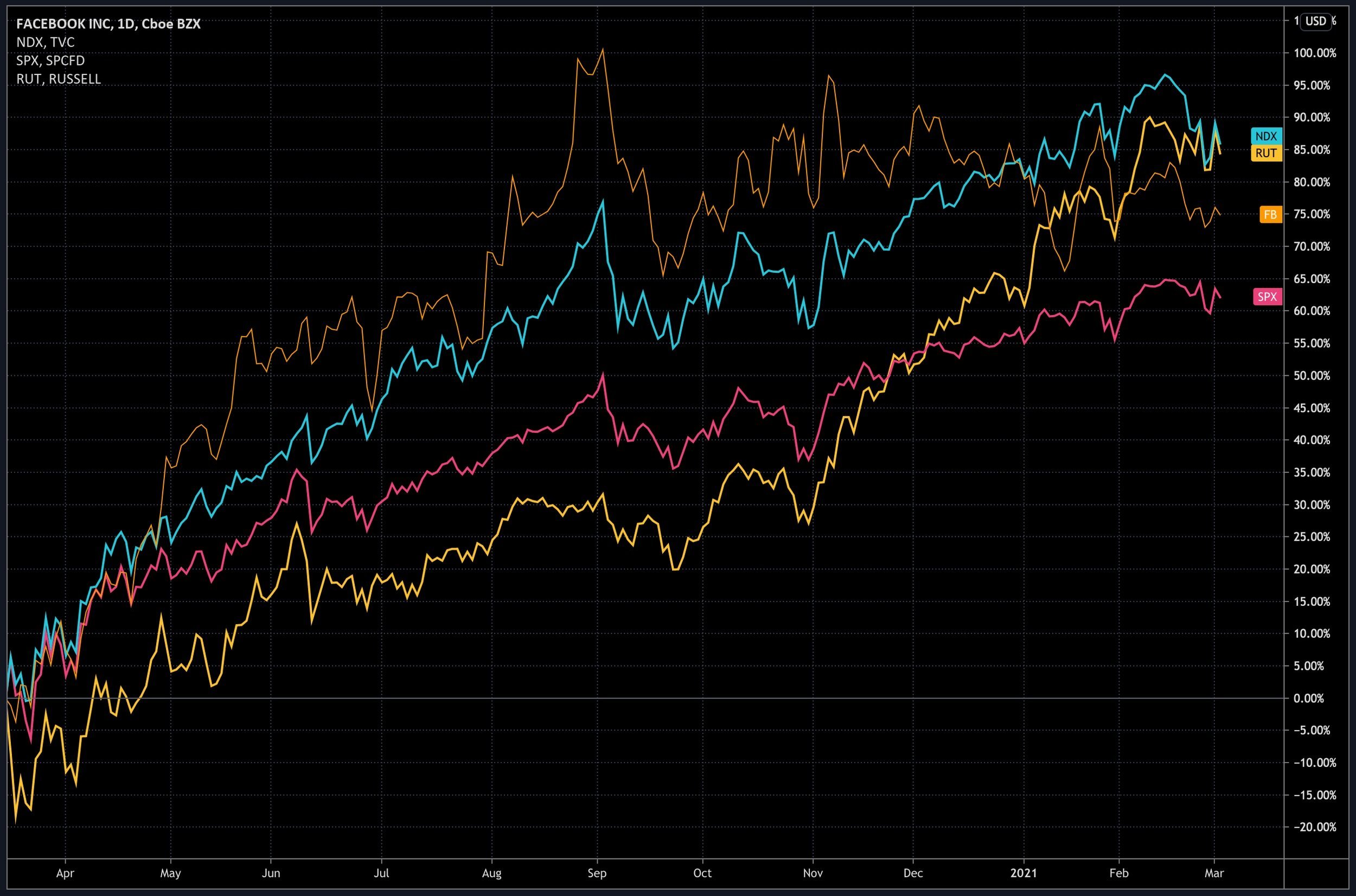

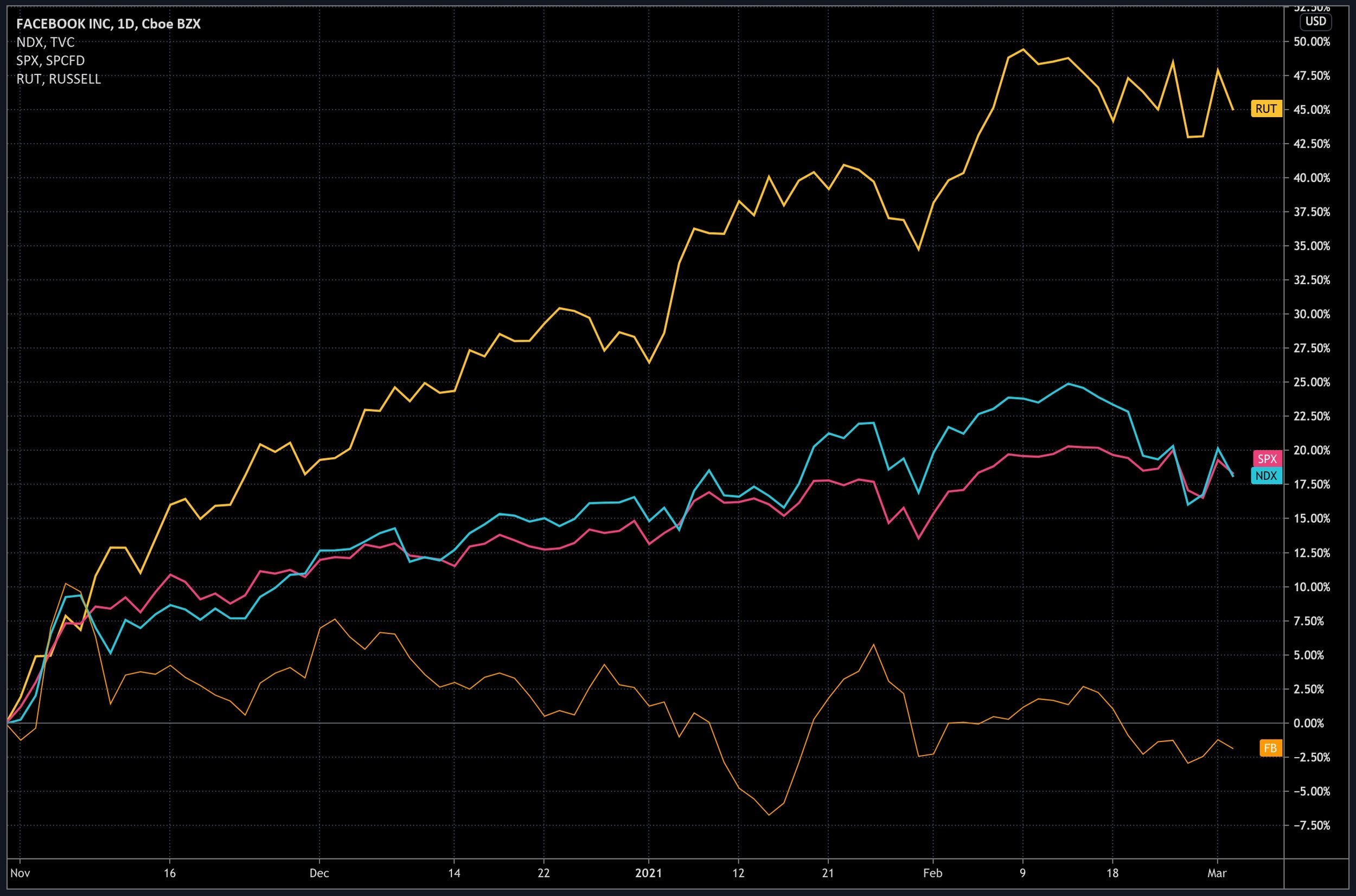

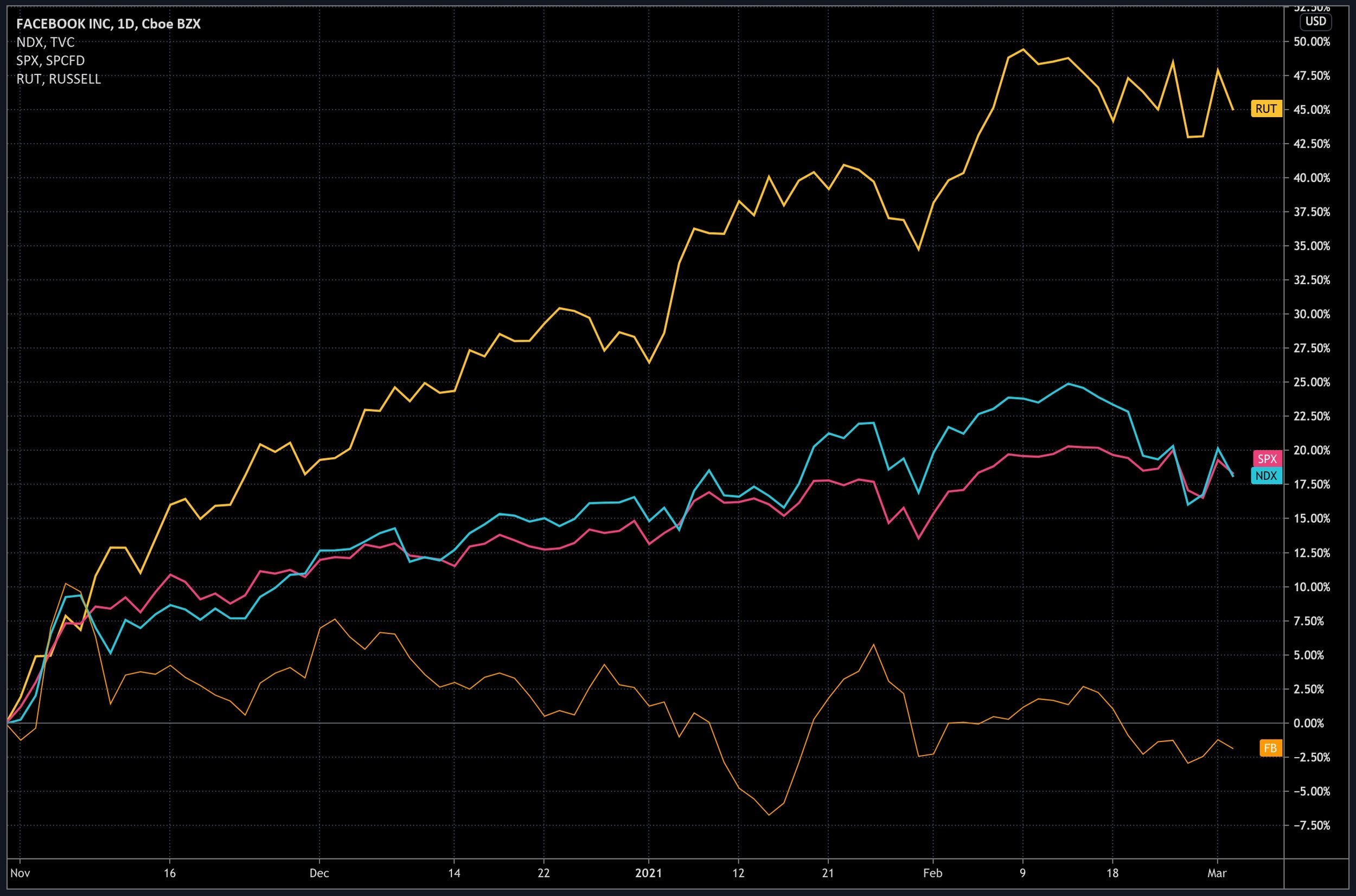

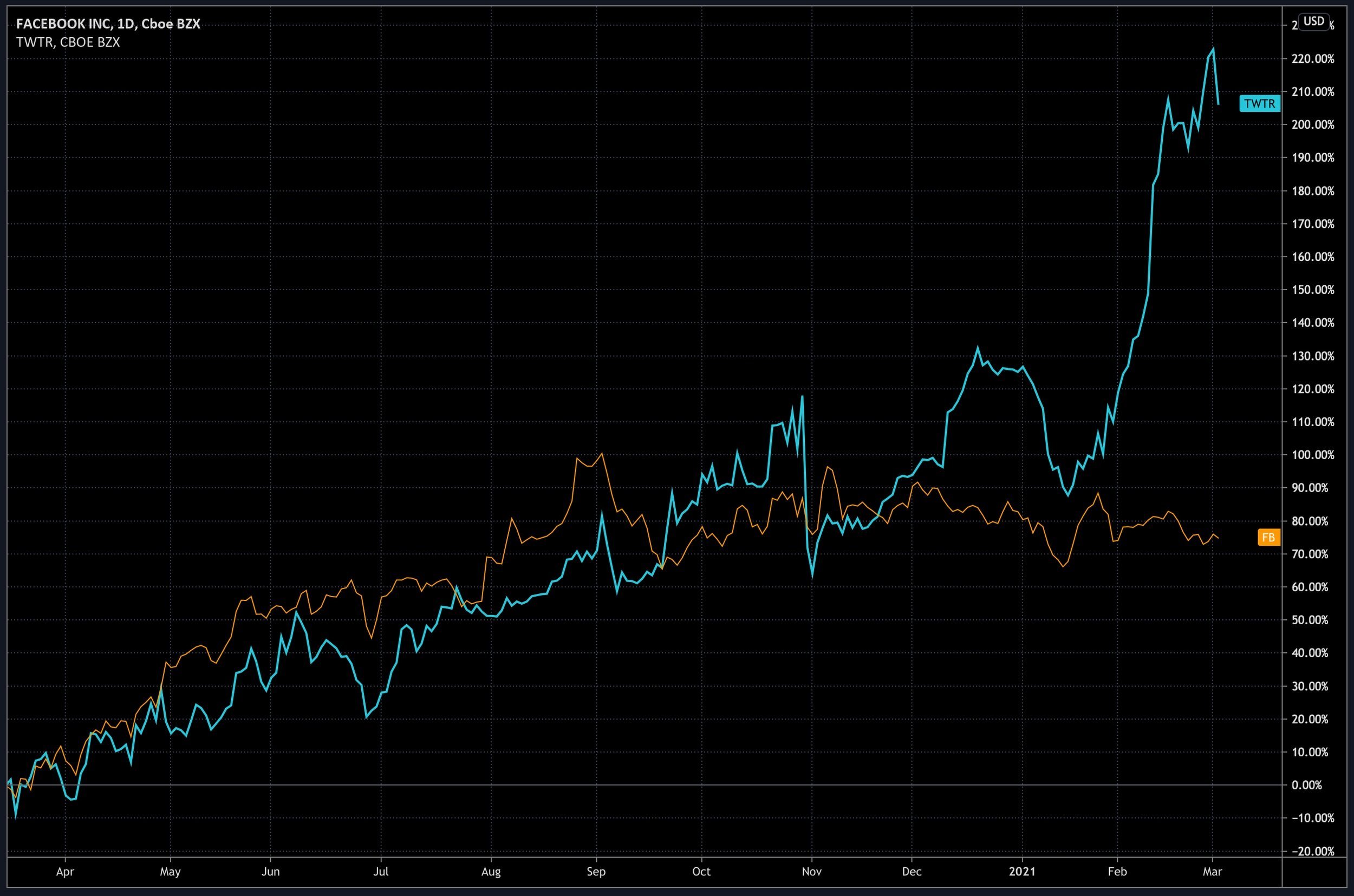

Facebook has been the weakest performer of the Big Tech names since the March 2020 low as well as weaker than the major US equity indices since both the March 2020 low and even going negative since the 2020 Presidential Election - a clear sign that the Facebook era is over.

-

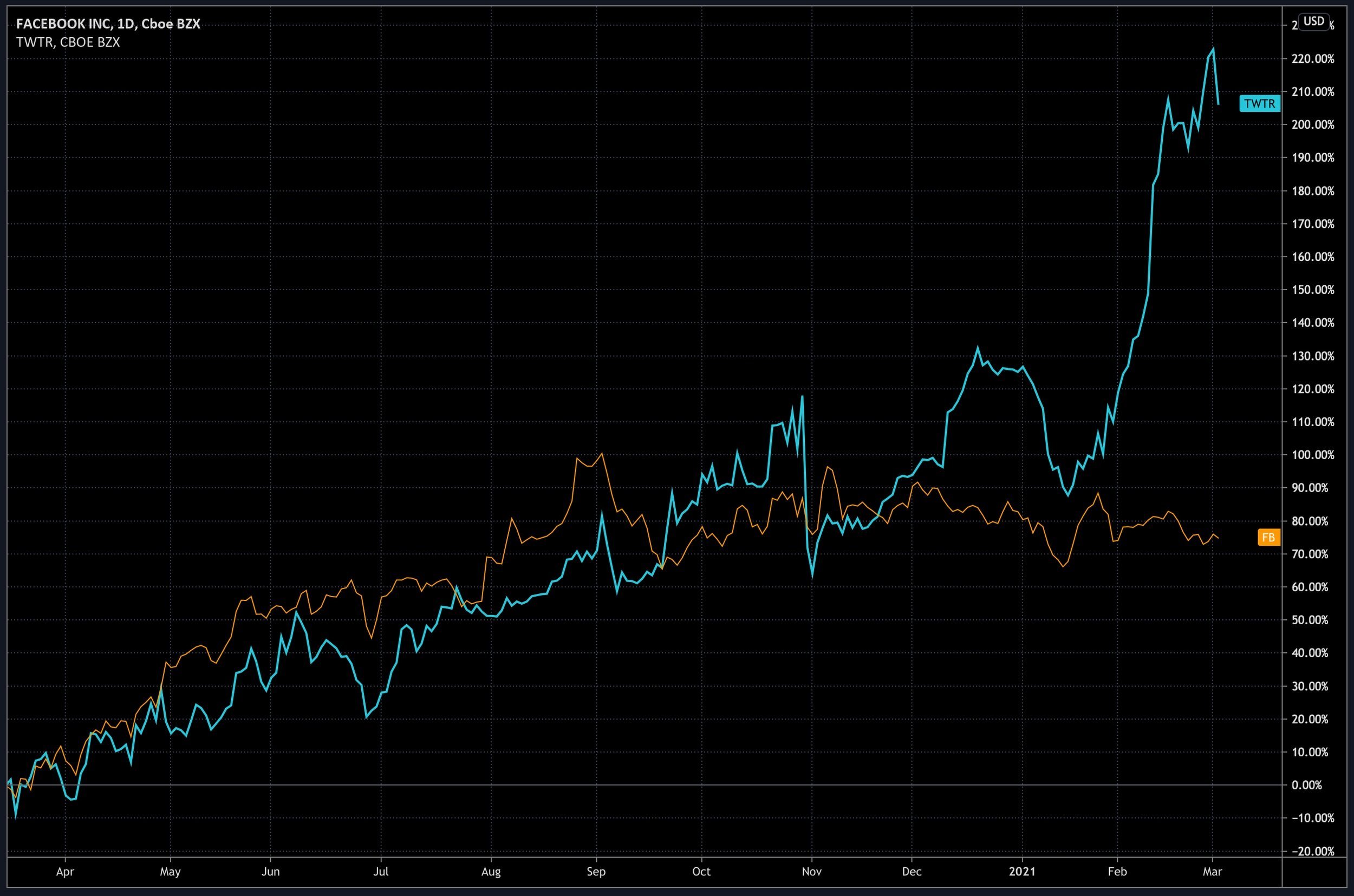

Twitter shares, in contrast, are off to the races – having hit a new high. Why? Twitter is a unique service provider and NOT a monopolist. In fact, Twitter is so unique – and small enough – it could become a merger candidate when the regulatory dust settles.

-

While Facebook may rally a bit – even go to a new high in a Fed fueled equity market – though I doubt it – once the political heat comes on to Facebook – then the break will likely begin.

Politics

-

With the second impeachment of Donald Trump, the appointment of new cabinet members, and dealing with the pandemic, the American federal government has been too busy to start to chase after the social media sector.

-

While the American government has been tied up with a new administration, the Australians (and many other governments) got started. The Aussies have mandated payments for accessing links to local news media. Facebook tragically decided to shutout Australia while Google found a way to pay for it, prompting Facebook to do the same soon after.

-

As there seems to be an unusual coalition in the US Senate building to break up Facebook between far-left leaders like Elizabeth Warren and far right leaders like Tom Cotton, Facebook will likely weaken quickly if centrist Republicans and Democrats unequivocally indicate support for Facebook to be broken up. Interestingly, Australia had bipartisan support to go after Facebook.

Technology

-

The Big Tech companies are all responding differently to the regulatory and fee challenges that governments are adopting. As mentioned, Apple is going pro-user. Avoiding the limelight, Microsoft has already negotiated a deal with the EU on how its Bing search engine works. Google agreed to new terms with Australians on news fees, leading Facebook quickly to the same place too.

-

The EU has announced that it may begin to regulate algorithms, particularly on social media sites, as they intermediate so much of our lives today. The Harvard Business Review produced a report about this on March 1, 2021 entitled “Can the EU Regulate Platforms Without Stifling Innovation? Written by Carmelo Cennamo and D. Daniel Sokol, they make the argument that the recently announced EU Digital Markets Act will hurt small business and not meaningfully improve outcomes for users. This is a complicated subject that I need to study so I don’t have an opinion on this yet other than if Facebook has less viral content, then revenues are likely to decline.

-

In 2020, Tim Cook stated that Apple does not maintain data files on its users. This policy is really turning into a competitive edge for Apple, who is becoming as pro user as possible. This will turn privacy issues into a strength for Apple, who doesn’t need it to aggressively exploit user data to generate revenue.

ESG (Environmental Social Governance)

For a Sustainable Future

-

Environmental: Deceptively Negative

-

Facebook is an excellent case study in how a company how can have a high environmental rating through using its vast profits to buy carbon offsets and green energy for its direct operations. But the real environmental risk that Facebook creates comes from the IMPACT of its operations that foster polarized politics and promote ideas designed to prevent any agreement on what constitutes basic facts.

-

Collectively, these 2nd and 3rd order changes are highly material for investors as they impair the sound functioning of the American government and represent a gross failure on the part of the ESG ratings industry to capture in its evaluations.

-

Thus, Facebook may have a high environmental rating from the way it conducts its own operations – but from a Macro ESG perspective, Facebook deserves the lowest possible Environmental rating.

-

-

Social: Destructive

-

As stated earlier, “The negative externality of online radicalization is a huge, possibly even catastrophic, cost to society at the national level and across the world. As we have seen with ISIS / Daesh and Al Qaeda, it is extremely important to prevent people from getting disconnected from reality and caught up in fringe groups that are expert at grooming and cultivating vulnerable potential recruits. It is essential that social media keep people from going rogue.”

-

Now, with the heightened activities of law enforcement following the events of January 6th, subversive elements are simply getting off of open social media and going underground to encrypted meeting rooms or on the “dark web.” Unfortunately, the cat and mouse game that was the provenance of offensive intelligence capabilities to identify would be terrorists is likely being turned inward and it is difficult to say what the unintended long-term consequences will be.

-

Therefore, from a Macro ESG perspective, Facebook deserves the lowest possible Social rating.

-

-

Governance: Negative

-

For all of the reasons elucidated under Environmental above, Facebook deserves the lowest possible Macro ESG Governance rating – in spite of it quickly banning Donald Trump.

-