Macro ESG - New Developments

greg beier macroESG.com Wednesday 30 September 2020 05:01 PM EDT

Subscribe to the Macro ESG Podcast: Apple Spotify Google Anchor links to other providers.

Markets, Politics, and Technology for a Sustainable Future

I just spent a month using a Bloomberg intensively to see if it could do the trick to help with Macro ESG.

And it didn’t work.

Why? Specifically, the data sets that are required to think about Macro ESG are varied and intense. For example, I was doing an analysis of Angela Merkel’s refugee policy decisions which - inevitably - leads one to study German demographics. While the Bloomberg had each country’s population, it did not have fertility data (this insight is to be published soon - I’ve legal pads and Word files full of ideas from the hiatus).

And that is exactly the opportunity. The Macro ESG business is for polymaths to support specialists. And it is desperately needed.

Yesterday morning, I did a review of the hedge fund activity since the earliest mentions in the mid 2000’s of the ESG / Sustainability / Responsible investment space and the bottom line - nobody has made any money. So, the real key for this space to really grow is that it simply has to make money (please see The Looming ESG Bust from July 13th for a view of the traditional ESG investment business).

Time for ESG to Make Money

And that’s exactly what Macro ESG is keen to support. Of course, I care greatly about the world - but it also has to make money, as that’s the whole point of harnessing the great capitalist system to do the right thing. For example, peacock feathers are often used in Asian culture as a metaphor for turning poison into medicine because peacocks can digest poisonous foods without harming themselves. In fact, this very trait is the reason that their plumage is incredibly rich and varied - the expression of their consumed toxins. Similarly, the ESG / Sustainability / Responsibility benchmarks and methods are so varied as it seeks to figure out how to to turn finance into an overwhelming force for good.

Three decades ago, when I was working at Cowen on Wall Street, in a fit of inspiration during a dead afternoon, I left the trading desk where I wrote a daily macro strategy piece for the fixed income department, and went to the C.G. Jung Institute and, via the librarian, was connected to a brilliant scholar at Columbia (who soon became a friend) and he explained to me that money is the nervous system of humanity (in archetype terms).

In fact, macro markets - currencies, interest rates, equity indices, and commodities - are like the patient’s vital data that is always collected when you arrive to meet any physician - Macro ESG is quite literally tracking the pulse of the world.

US Dollar Nominal GDP Distortion

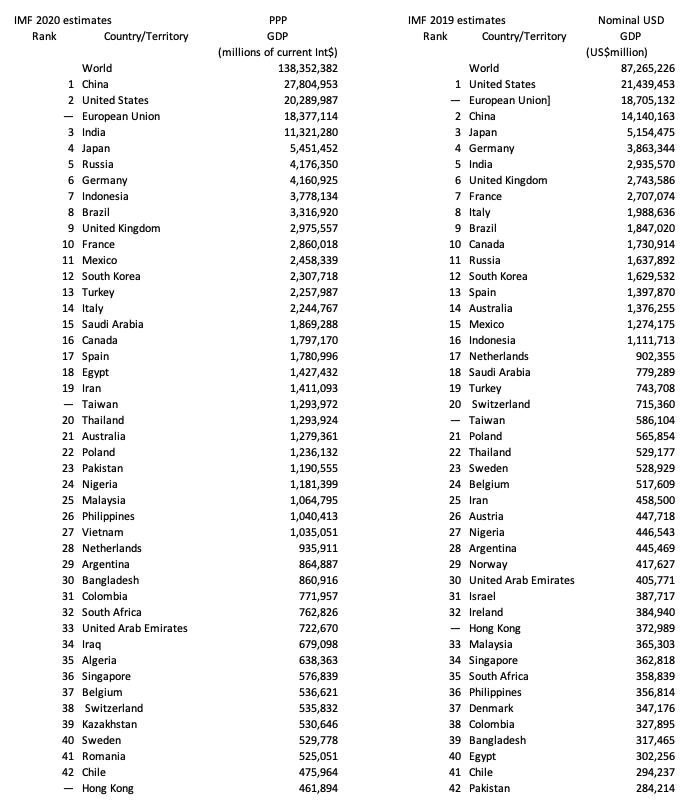

So, after thinking it over - I’ve decided to cover the G20 markets on a daily basis - but organized on a purchasing power parity - PPP - basis. Why? I think that there is a kind of US dollar nominal GDP blindness that misses what’s really happening in the world.

On a PPP basis, China is #1, the US is #2, the EU is #3, India #4, Japan #5, Russia #6, and so on. In fact, I heard a senior member of a European parliament say privately just the other day that Brazil is “a poor country.” But, in the IMF’s April 2020 PPP GDP estimates, Germany is #7, Indonesia #8, Brazil #9 , UK #10, France #11, Turkey #14, and Italy #15.

I think that it is a tremendous mistake - hubris even - for Americans (and other similar rich democracies) to think that they (or I should say we as I’m an American) are #1. This is a mirage and a source of trouble ahead in the markets so Macro ESG will try to get ahead of that problem.

I was listening to a brilliant talk recently by a retired American diplomat, with many years of experience, who felt that America was making a big mistake with the excessive, reflexive belief that “We are number 1.” His wisdom and years of experience validated my decision.

The world looks very different in PPP GDP terms vs. Nominal USD GDP

I started Macro ESG with the idea that I’d jot down a few of the big ideas that I’d been working on and then get a structured research flow going - but the rush of events around Covid - and the pace of change in the world at large - is so huge - overwhelming even - that I was drawn into writing about everything that’s been happening without having a structure to the research. This will change now.

New Idea to Be Announced Soon

I also spent a fair amount of time putting the finishing touches on a terrific idea that I’ve been working on for years - and whose time has come.

The biggest problem in the ESG / Sustainable / Responsible investment space is data - metrics - taxonomy. I’ve a possible solution to help make this problem actually manageable, so once it gets through legal - I’ll begin sharing it far and wide. I hope it helps! We don’t have much time to get it right.

So, Macro ESG will be following the markets closely and writing upon this daily with quick comments on politics, technology, and a sustainable future. Larger pieces will come organically every few days or so, and will be tied to actionable ideas.

The biggest drawback to Macro ESG - and really the reason that I stopped publishing for a bit - is that I was too focused on big ideas - the cosmology of the markets - and not enough on actionable ideas.

I’m really excited to build out the Macro ESG research process with an emphasis on global power dynamics of markets, politics, and technology for a sustainable future - these are the key factors that ultimately will drive us to a more sane world - or not.

But what’s been missing is a really skillful action that makes Macro ESG super useful and relevant. Please stay tuned for that development shortly.

And please reach out if you have any thoughts or ideas. I’m keen to collaborate with partners.