#1 of 6: Dollar Hinges on Election Post Stimulus Self Destruction

greg beier macroESG.com wednesday 26 august 2020 06:41 PM EDT

Subscribe to the Macro ESG Podcast: Apple Spotify Google Anchor links to other providers.

Markets, Politics, and Technology for a Sustainable Future

#1 of 6: Dollar Hinges on Election Post Stimulus Self Destruction

Summary:

-

Republicans and Democrats are each stalling fiscal stimulus to either support or hurt Donald Trump in different ways and influence the result of the election.

-

President Trump attempted to protect himself politically with an executive order to supplement unemployment insurance and win support with the electorate.

-

The US stimulus political battle darkens the prospects for the dollar.

-

America’s macro ESG “S” and “G” ratings will decline, exacerbating the dollar’s weakness.

Macro ESG

-

Macro ESG is a new method of analysis that attempts to forecast changes based on G20 markets, politics, and technology (collectively, “macro”) for a sustainable future (“ESG”).

-

These attributes are, taken together, interdependent global power dynamics that, I believe, will be the primary driver of change in the 21st century.

Zombie Markets Wake-Up Foreign Exchange Trading

A belief has taken hold in the marketplace – which I have also expressed on Macro ESG in the piece Pavolvian Economics and Zombie Markets: The Long-Term Forecast of Quantitative Easing on July 6th – that as the bond market is locked down in zero rates for the time being – the only way for sovereign views to be expressed now is through currency changes. Although, after listening to Ben Melkman of Light Sky Macro eloquently describe the same basic idea, I am starting to wonder if this is wrong – perhaps, it’s too obvious?

This becomes all the more relevant as the Chinese equity market is getting ready to make a move up with a bump up in the RMB too.

What the Democratic and Republican leadership are not counting on right now is that other nations are competing against the US – most notably China on its own (now cooperating with Iran and even Saudi Arabia on yellow cake for a nuclear program).

If John Maynard Keynes were alive today, he would be apoplectic with the US government for letting the stimulus solution go unresolved for so long. Source

Angry Central Bankers

Janet Yellen is furious with Republican and Democratic leaders in both the House and Senate as well as the Trump Administration, as reported in The Hill.

And for good reason. This pandemic economy can’t be fixed with central bank policy – there has to be a solid fiscal component as well. And Fed Chair Powell, to his credit, has been very open about that – repeatedly.

And, yet, the leaders aren’t coming together because there is too much polarization – which opens the US up to making a great mistake, just like what happened when Ben Bernanke asked for Congress to do its job in 2011 and they didn’t, resulting in more economic pain for the US.

What’s particularly worrying, from a Macro ESG perspective, is that it will lower America’s macro “G” rating amongst global investors as well as its macro “S” rating too.

And the macro “S” rating has had a huge impact on the US dollar, lowering the dollar a quick 7% with the social unrest following the death of George Floyd in late May.

If America demonstrates lower social cohesion, then investors will get out of USD assets and search for other alternatives where social cohesion is higher during a pandemic.

America’s national politicians have become oblivious to reality as a group – they’ve forgotten that there is a dangerous, competitive world out there and are opening up the US to negative feedback from the markets – which will disproportionately affect the most vulnerable in the US, further exacerbating the macro “S” problem and creating a reflexive (self-reinforcing cycle in Soros speak) that will drive the US dollar lower.

Quick Macro Assessment:

-

Interest rates are at zero and so bonds and rates don’t really matter.

-

Equities are only up because of central bank intervention – and this is mainly in a handful of tech names who are now a quarter of the S&P500 market cap – who knows how long this will last?

-

Markets are broken – we are in zombie land – so my concern is that the logical place for pressure to be expressed in the dollar.

-

And the only thing that is going to determine the USD is the policy environment – and that will entirely be determined by the election of the President and control of the Senate.

-

And the election will be determined by the fiscal car crash that is brewing in Washington.

But the Virus Marches On

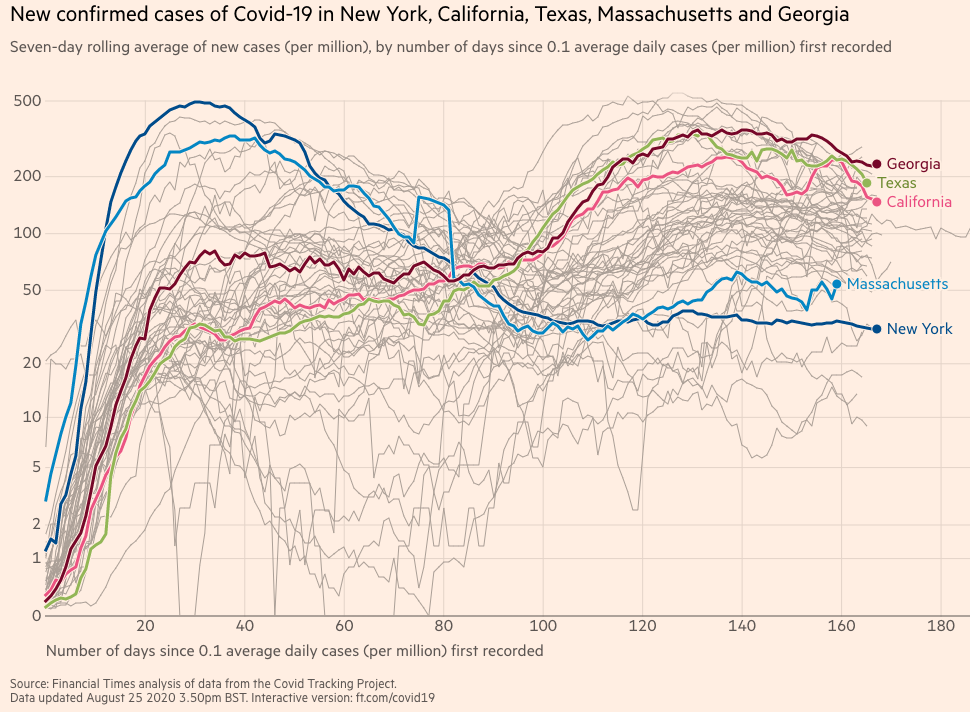

The worry is that the US will be unable keep the virus from abating as the country gets swept up in another wave this winter.

Donald Trump’s Taxes

The Democrats are preparing to defrock Mr. Trump right before the election – Mr. Trump will be exposed for being a lot less wealthy than he claims through having his tax returns made public – thus depriving the one area that voters believe he is strongest – his ability to run the economy. Mr. Trump will be presented as broke in the week before the election, much like Mr. Comey reopened the investigation into Hilary Clinton’s emails.

American Elites are Stuck in a Perverse Battle

-

The bet that the Democrats are making is that they can throw the structurally and pandemic unemployed under the bus and have the cries of the working poor drive independents and weak Trump supporters to the Democrats in the run up to the election.

-

Similarly, the Republicans are betting that by starving the Blue (i.e., Democratic) state and local governments of funds, that they will be able to make a solid case that the Democrats don’t know how to rule, can’t be trusted, even though these areas were hit first by the virus and dealt with the pandemic far more effectively – especially New York – than the Red states.

-

And this is the crux of the battle on stimulus – which could threaten the economy as the eviction moratorium has run out. As I have said earlier, I believe that this is an exceptionally risky thing for both parties to do because the US isn’t the only game in town, as the elites in Washington have apparently forgotten.

Now the whole thing is coming to a head, and the danger is that what was a little fire could burn the house down if it gets out of control. Mitch McConnell clearly sees the risk too as he excoriated Ms. Pelosi for failing get a deal done.

-

Ms. Pelosi’s gamble has started to fizzle out because Trump used his executive authority to get $300 a week in supplemental unemployment benefits which drove Ms. Pelosi back to the negotiating table.

-

The Republicans can’t come up from their $1 trillion stimulus figure because if they take the pressure off of the Blue cities and states, they risk being completely wipe out in the November elections.

-

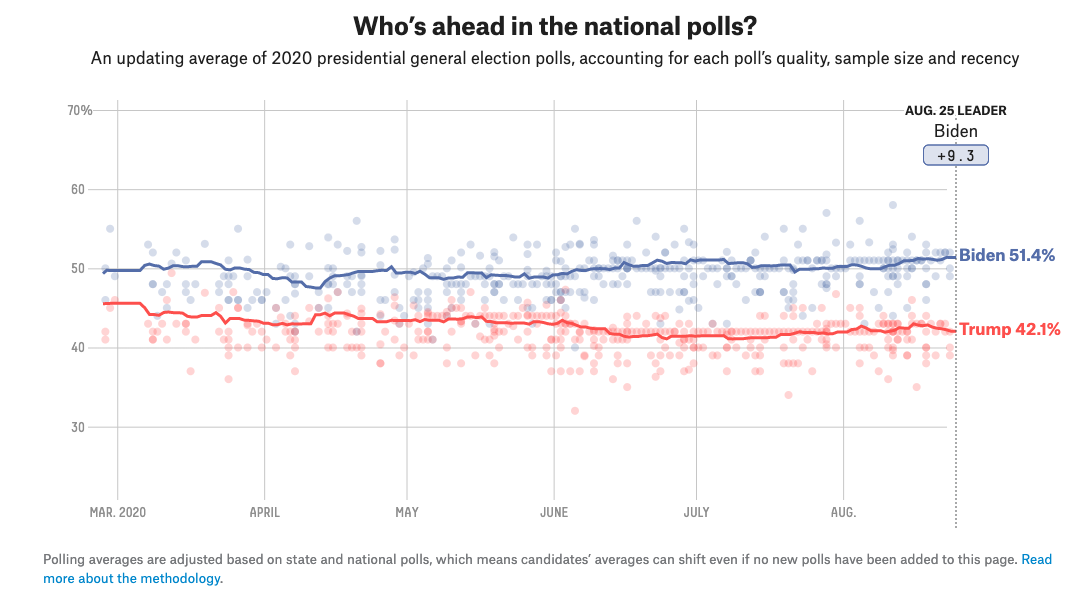

In addition, the Republicans believe that they have out-foxed the Democrats through President Trump’s Executive Orders to supplement unemployment benefits. This did bring Speaker Pelosi down a bit in her bargaining position but with the President polling solidly at around 42% approval rating – they are not ready to budge either.

So, a big gamble is underway in Washington between the two parties, while the virus marches on.

What are the investment implications?

-

It’s not really a gamble actually. A crisis amongst the electorate will hurt Donald Trump and the Republicans more as they are the incumbents, as much as Mr. Trump likes to run an outsider campaign. The public will view him as being responsible for what is happening.

-

Then, the expectation will be as he is going down, the Republicans will break with him and then the Democrats will be able to beat a veto or the President will go with them.

-

Unfortunately, a lot of innocent Americans are going to get hurt in this political battle and there is the risk that the dollar could take a hit – especially if more unarmed African-American men are shot by police in the run up to the elections, which could spark more protests.

-

This is what makes the current environment so difficult to predict – kind of like the butterfly effect in chaos theory. If more George Floyd incidents are caught on video by passersby, then it’s hard to say how markets will trade without paying close attention to prices and news on daily basis.

-

The stock market and the dollar should come under pressure during this time. This sentiment should hit emerging markets – which are sensitive to US developments as many are trading tightly with the US.