#2 of 6: China Builds Investment Alliances with Oil Suppliers via Rising RMB + Equities as US Squabbles

China Import Commodity Volume Petroleum Oil

China Import Commodity Volume Petroleum Oil

#2 of 6: China Builds Investment Alliances with Oil Suppliers via Rising RMB + Equities as US Squabbles

Summary:

China is likely preparing the RMB to rally along with the stock market. Perhaps China is doing a deal with the non-China SWF’s – which would make sense. Governments talking to governments – building strategic alliances of capital and trade – new blood brothers.

These new alliances of “mutually assured growth and political control” will have a big impact on the evolution of global development.

Unless the advanced economies respond forcefully, the world is entering a dark phase.

As the oil industry is officially becoming relegated to the back waters when the largest market cap company in the world was Exxon in 2011 and Exxon has just been pulled from the Dow Jones Industrial Index, oil is about to make itself felt in another big way.

View fullsize

USDCNY - Weekly

USDCNY - Weekly

China Leads Covid Response While US & EU Falters

Infection rates are rising in South Korea, Italy, France, and Spain – and the US has come down a touch from the peak, but this entire saga is far from over.

Presently, China has a relatively very low Covid-19 infection rate while the EU is suffering from a resurgence and the US remains stubbornly high. If China’s statistics are to be believed (a big if), then China is the envy of the world.

View fullsize

America’s Stubborn Covid Rate and the Rise of Europe’s Covid Rate are Going to Create Unique Opportunity for China in the Global Power Dynamics

America’s Stubborn Covid Rate and the Rise of Europe’s Covid Rate are Going to Create Unique Opportunity for China in the Global Power Dynamics

Therefore, China’s Covid relative outperformance – if true – is bound to tempt some large sovereign wealth funds and tax-free oligarchs to invest in China simply on the thesis that China is essentially infection free while the US and the EU are about to go through a large second wave this winter.

Moreover, the US Congress is unable to come up with a stimulus bill and is about to have a supremely messy election with a President who has repeatedly stated that he will not accept the election results if he loses. All of these events are likely to make China appear relatively stable and orderly – and become a desirable destination for capital.

I believe that China is on the verge of seeking to tighten alliances with foreign nations – both friendly and hostile to the West. My guess is that their biggest target will be the petro-nations. This is China’s biggest risk to development, and they will be seeking to turn these energy suppliers into investors, much like the way petro-dollars worked in the 70’s.

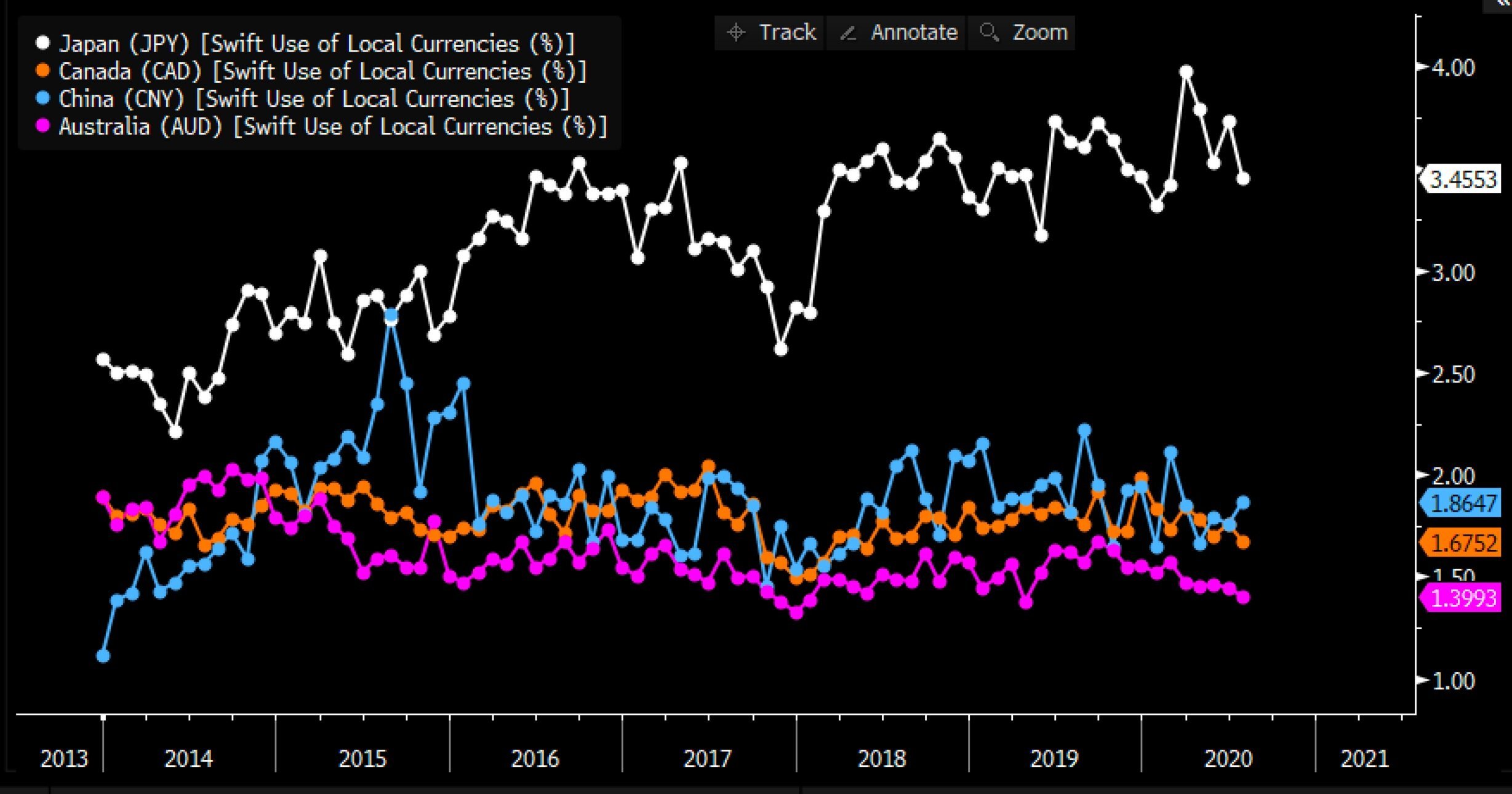

The result is that the Chinese stock market and the RMB are very likely to go up in order for nations to be eager to invest in China, hold China’s RMB, and – perhaps most importantly – own China’s government bonds to keep the input-driven debt-fueled growth machine going and fund China’s next move against the US and Europe in advanced electronics, aviation, and pharma.

China is about to become an investment destination. The Chinese government may offer minimum returns on investment too.

Of course, their partners will be reticent about initially participating, but this scenario makes perfect sense so it will undoubtedly grow.

It is also China’s first step in knocking the US out of reserve currency status – which will create increased costs for the US to roll its deficit, if they are successful.

China is already lending money around the world (often described as the world’s largest creditor), which the Harvard Business Review did a good job of attempting to estimate – this is hard to do as the Chinese are not disclosing their activities publicly.

China Practices “RMB Diplomacy”

Starting with their suppliers of crude oil, China’s number one target will be Saudi Arabia because 1) heavy with cash and 2) China is Saudi’s largest buyer of crude as well as Saudi’s largest source of imports. Plus, crucially – the Wall Street Journal reported on August 4th that China is secretly building Saudi Arabia a yellow cake processing plant, a key first step for the Kingdom becoming a nuclear power in a bid to counter Iran.

China’s Top Providers of Imported Crude Oil

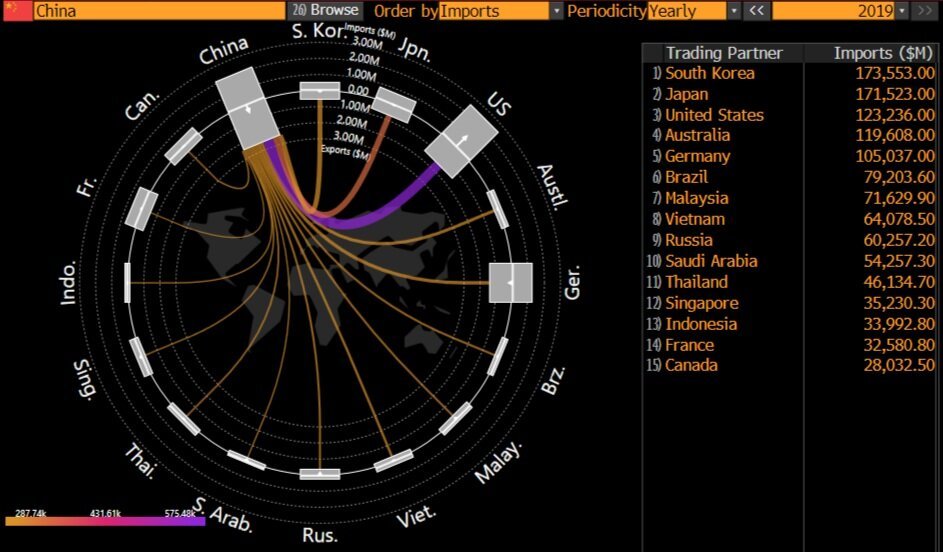

Below are the top 15 countries that supplied 90.1% of the crude oil imported into China during 2019.

Saudi Arabia: US$40.1 billion (16.8% of China’s total imported crude oil)

Russia: $36.5 billion (15.3%)

Iraq: $23.7 billion (9.9%)

Angola: $22.7 billion (9.5%)

Brazil: $18.5 billion (7.8%)

Oman: $16.4 billion (6.9%)

Kuwait: $10.8 billion (4.5%)

United Arab Emirates: $7.3 billion (3.1%)

Iran: $7.1 billion (3%)

United Kingdom: $6.3 (2.7%)

Congo: $5.54 billion (2.3%)

Malaysia: $5.5 billion (2.3%)

Colombia: $5.4 billion (2.3%)

Libya: $4.8 billion (2%)

Venezuela: $4.4 billion (1.9%)

View fullsize

China Imports 2019

China Imports 2019

View fullsize

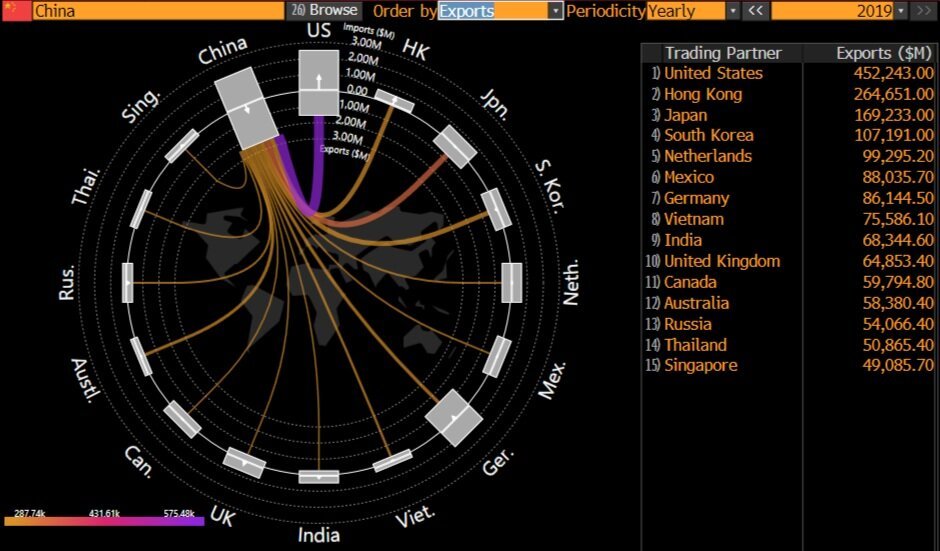

China Exports 2019

China Exports 2019

Big Changes are Ahead in Central Banks Global Reserves

Big Changes are Ahead in Central Banks Global Reserves

View fullsize

What’s the Best Way to Make Money for Your Clients?

A hot IPO! The emerging markets energy suppliers will get an allocation of the just announced IPO of Ant Financial – this will be designed to push out the US in the emerging markets space and reduce US emerging markets cooperation as well as highlight China’s rising technology success (just another example of China’s Digital Mercantilism).

As the both the RMB at 6.90 and China’s equity markets looks good, China is also demonstrating excellent relative strength in the world’s markets today. China is willing to play ball with the emerging markets petro-states. China’s position will be, “If you want to keep your offshore cash here in Hong Kong (or wherever you want) so long as you invest in China – it’s your money, tax free. We will not sanction you, like the US has done.” That should be a compelling pitch for a lot of people.

View fullsize

China Outperforms US in 2020 Year to Date Comparison of SP500 and Shanghai Composite (in local currencies)

China Outperforms US in 2020 Year to Date Comparison of SP500 and Shanghai Composite (in local currencies)