How Biden’s Plan to Decarbonize America Will Impact the Dollar

Gregory C. Beier

Macro ESG Strategist & Founder

Sustainability Arbitrage LLC

Tuesday, December 15, 2020 11:02 PM ET

“Markets, politics, and technology for a sustainable future.”

What will Big Oil Do Next?

It really depends on what Joe Biden does. If he brings a sweeping plan of economic justice and actually manages the decline of hydrocarbon use proactively, with real fairness, then he would become the Abraham Lincoln of the environment.

What’s needed to get this right is more than just cash - it’s ideas and leadership. A whole new suite of programs are going to have be clearly thought through. America is going to have to learn from its European and Australasian partners. It’s a huge undertaking.

The reason that I begin with this line of thinking is simple. This past weekend, the US Supreme Court voted unanimously to toss out a challenge to the election (incidentally, I wrote earlier on Macroesg.com that they would reject it to preserve the court as an institution) brought by the state of Texas against the states of Georgia, Pennsylvania, Wisconsin, and Michigan and signed by 16 other Attorneys General - all from deeply Republican states - most with strong ties to the hydrocarbon economy.

And that is exactly the point - this case that Texas brought was not about Donald Trump. The simple fact that this case was brought by Texas, home of the Permian Basin and so many other big oil finds, tells you all that you need to know. It was 100% about oil, coal, fossil fuel processing and related industries. It was a last ditch attempt to do anything they could to prevent a new president assuming office whose stated goal is to end the use of fossil fuels in America by 2050.

So, my concern is, how will President Biden heal this? Through amazing leadership, policy making, and policy implementation - of course.

But if Joe Biden doesn’t deliver this, then the US is going right up to the line again of seditious acts like the Texas case that was dismissed this weekend. The wave of protests that swept France when President Macron attempted to implement a carbon tax nearly brought his government down shows just how precarious this will be.

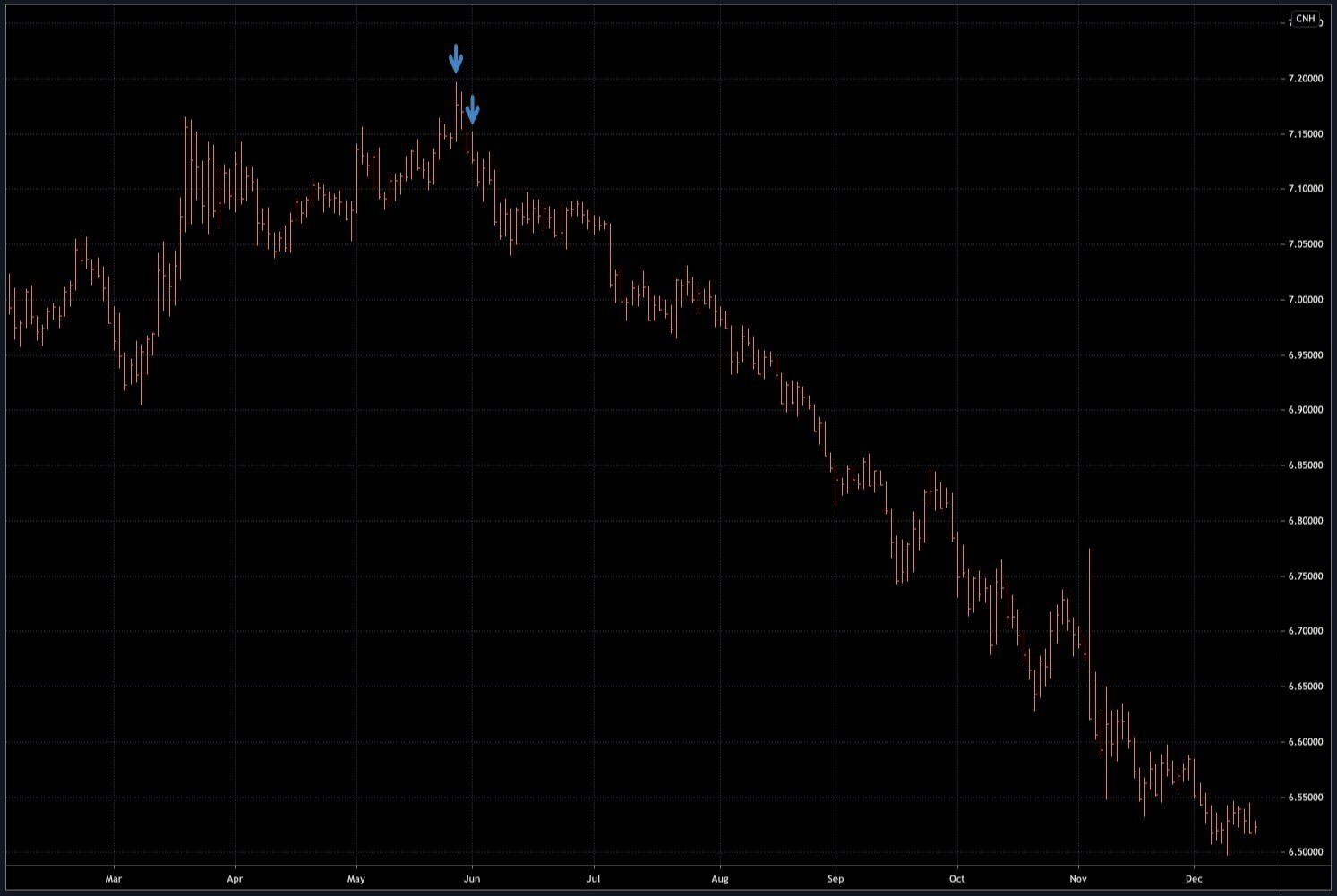

America’s ESG Social assessment will decline and with it the US dollar, just as the US dollar tanked on the death of George Floyd with the ensuing race and class protests that followed. In fact, the recent low of the Chinese yuan is the very same day that George Floyd died.

USD/CNH, Daily, 2020. First arrow - May 27th marking the low, two days following the death of George Floyd, Second arrow - June 1st - President Trump calls the active duty military out on to the streets which the Pentagon declines.

The good news is that Joe Biden’s priority is starting with decarbonizing the electrical grid which is a fairly easy decision to make and implement. It also delivers by far the biggest change in carbon emissions. And it doesn’t really touch people’s lives right away so it gives the country a chance to get behind this bold plan, learn and understand it as well as have technology improve too.

So, as the US dollar declined precipitously on the wave of protests across the country over the summer, I don’t believe that will happen again. In fact, if President Biden can calm the country down after the Covid debacle - which I expect he will - then the US dollar will be steady to up.

America is divided and weak. It’s up to Joe Biden to pull the country together by setting out a plan for a sustainable future and to educate Americans about why it’s necessary to make the change and how it will benefit them.

Macro ESG Summary

In summary, the US dollar’s value is determined by S - Social assessment (class and race divisions) which is primarily determined by its G - Government assessment (capability and leadership).

Investment and Trading Plan

If a surprise event comes up - like a bad ending to the war in Afghanistan - that leads to protests in the US and a decline in the Social assessment, then the US dollar is a solid short. If other bad Government actions/decisions drives Social lower, then the USD is a very solid short.

Conversely, if Joe Biden maintains strong social cohesion and pulls the country together after Mr. Trump leaves office with a solid plan that the country buys into, then the dollar is all set to be steady to up. In Macro ESG speak, if strong G leads to steady to strong S - then the USD is a buy.

A Transformational President

Presently, I believe that Joe Biden is going to be able to pull the country together and become a transformational President as the Yale political theorist Skowronek wrote about. We are entering a rare moment in Presidential time. Biden’s ascendancy to the Presidency is like the arrival of FDR or Reagan (both of whom beat one-term opponents from the opposite party who brought business skills to the White House (Hoover and Carter, much like Trump).

Big oil nearly drove the US system too hard this past weekend with its vociferous assault on the very girders of democracy. Between President Trump endlessly lambasting the election system as fraudulent and rigged while he raised over $200 million, approximately 50 cases were tried on the fairness of the election, numerous recounts across the country, and the Texas action which drew so much support from members of Congress - of course US dollar should have weakened a touch.

But from another perspective - it is surprising that it has not weakened considerably more, given all of the negative news about America’s institutions.

I believe that the US dollar will be stable so long as the US manages a respectable extrication from Afghanistan.